- 10x Market Update

- Posts

- Buy or Sell Coinbase? And What $195 Billion in Bitcoin Inflows Tells Us about the Next 5 Months?

Buy or Sell Coinbase? And What $195 Billion in Bitcoin Inflows Tells Us about the Next 5 Months?

Actionable Market Insights

Why this report matters

Bitcoin just posted its strongest breakout since 2024—fueled by a sharp surge in inflows, call buying, and one of the largest short liquidations in years. But with implied volatility fading and the options market now aggressively pricing in a $140K year-end target, are traders too far ahead of themselves?

Retail volume is exploding in Korea, and altcoins are ripping—but the inflow math may be telling a different story. Meanwhile, Coinbase is now trading at a 22% premium to Bitcoin, near the top of its historical range. Is this the time to stay long, hedge, or fade the rally? The capital flow data, trend model shifts, and derivatives signals in this report reveal what’s likely next—and where the risk/reward is most asymmetric.

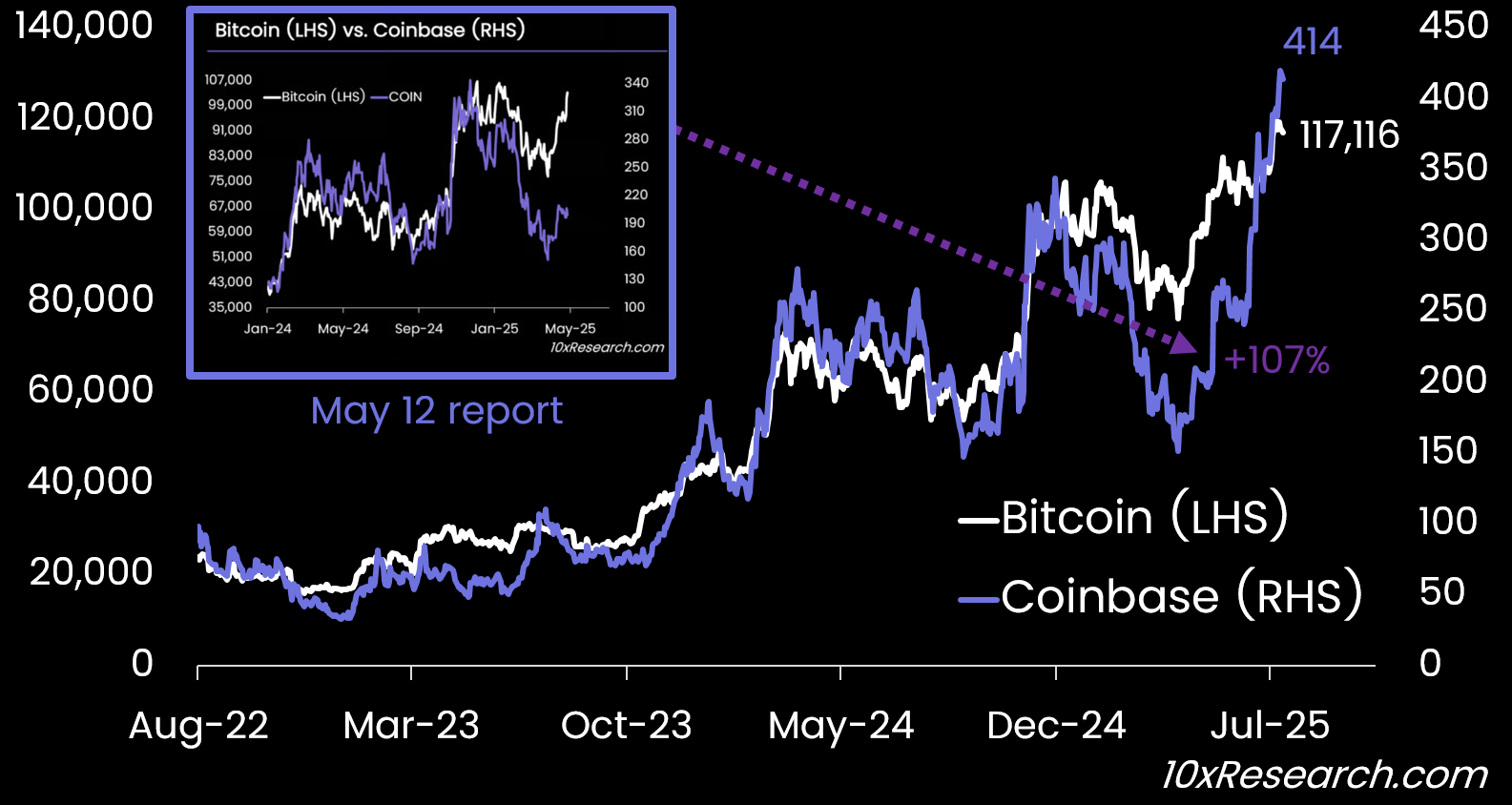

Bitcoin (LHS) vs. Coinbase (RHS), +107% since our May 12 report

Main argument

On June 24 (here), we turned bullish Bitcoin as it approached the end of a six-week consolidation. Anticipating a July breakout, we recommended going long Bitcoin at $104,000 while selling the $115,000 July 25 call, expecting a +10% move and viewing the call sale as an attractive yield enhancement. At the time, the call offered an 18% annualized yield, in addition to Bitcoin exposure.

That option, originally priced at $1,560, is now trading around $2,990 with just three days to expiry. While the call has moved against us by $1,400, the long Bitcoin leg is up $13,400, resulting in a net gain of $12,000 (so far). And with consolidation likely to occur into the July 25 option expiry, the call option could still lose value, ultimately capturing the yield we initially targeted.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.