- 10x Market Update

- Posts

- Why Wall Street’s Favorite Bitcoin Trade Might Be Hiding in Plain Sight

Why Wall Street’s Favorite Bitcoin Trade Might Be Hiding in Plain Sight

Actionable Market Insights

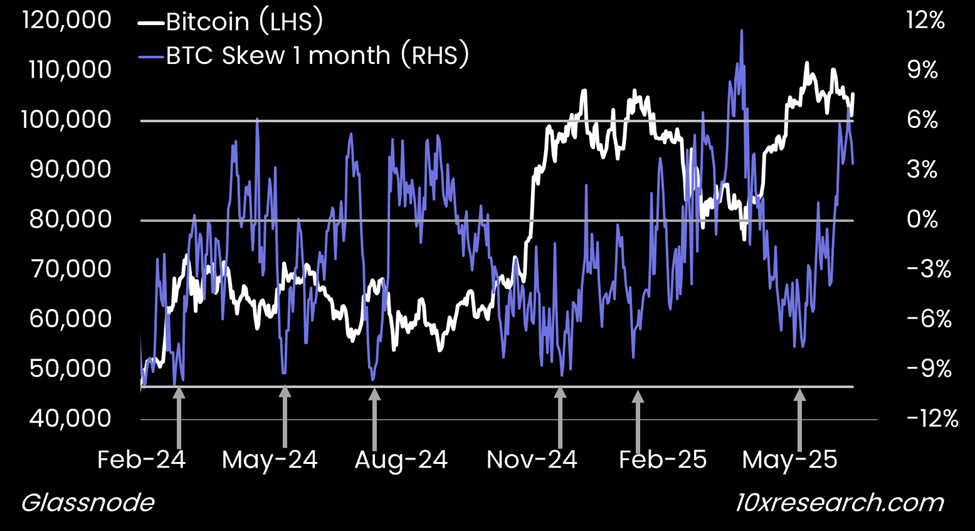

A month ago, in our May 28 report “10 Bearish Signals Bitcoin Bulls Are Ignoring Right Now,” we noted that “excessive bullishness, as indicated by BTC skew, often serves as a contrarian signal.” On Monday, that same skew reached levels typically associated with short-term Bitcoin bottoms. However, caution is warranted, as overall market liquidity remains thin, open interest in Bitcoin continues to unwind, and stablecoin issuance remains subdued.

Is Bitcoin’s skew signaling a buy signal?

Why this report matters

Bitcoin is trading in one of its tightest ranges in years, but beneath the surface, market structure is quietly shifting. Implied volatility is diverging across platforms, crypto-native retail speculation is fading, and institutional strategies are reshaping how Bitcoin yield is generated. Some of the most actively traded Bitcoin options are pricing in very different expectations, and that gap may signal where opportunity lies. Meanwhile, futures positioning is unwinding rapidly, just as macro narratives begin to shift. With the July FOMC meeting approaching and Powell preparing to testify, traders are positioning for what could be a pivotal summer.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.