Why this report matters

Bitcoin’s rally has stalled. Beneath the surface, key on-chain and derivatives signals that once fueled momentum are now fading. Institutional players are quietly tightening risk while retail traders remain trapped in breakeven limbo. Our proprietary models show this phase could determine whether the market resets—or reignites. Even with supportive macro trends and a strong equity backdrop, the data tells a different story. The real question now: are we witnessing another routine correction—or the first signs of a deeper turn?

Bitcoin (LHS) vs. Realized vs. Market Cap momentum indicator (RHS)

Main argument

Ever since my time on the hedge fund desk at Goldman Sachs, I’ve been building models and tools to analyze market behavior. That continued when I moved to Morgan Stanley, where I led the Quant and Derivatives Strategies group in Asia, and later during my years in the hedge fund industry. What makes crypto so fascinating is that the kind of internal flow data once exclusive to institutions is now openly available on-chain. The challenge is no longer access—but interpretation: analyzing the data and developing indicators that reveal the underlying narrative or confirm a fundamental thesis. After several full market cycles, these indicators have proven invaluable in explaining the evolution of Bitcoin.

We have maintained a tactically bearish stance, anticipating a potential pullback toward $100,000. While short-term headlines drive volatility, our models show that Bitcoin is trading near critical historical levels that often mark shifts between bullish and corrective phases. Smart money continues to trade around these signals, utilizing structure and discipline, while those operating without guidance tend to fade each cycle.

See our recent reports — “Bitcoin: Knowing When to Bet BIG — and When Not to Bet at ALL” (October 16) and “The ONE Bitcoin Trading Rule That Separates Winners from Losers” (October 14) — for deeper insights into market timing and position management.

For the second consecutive week, Bitcoin remains below its 21-week exponential moving average (EMA)—a level that has long distinguished bullish momentum from corrective or bearish trends. Respecting this moving average has historically meant the difference between riding the bull and watching from the sidelines.

Bitcoin (LHS) vs. 21-week moving average (RHS)

This is a moment for investors to reassess exposure. When Bitcoin traded at $10, HODLing was enough. However, history shows that selling near prior peaks, such as $20,000 in 2017 or $68,000 in 2021, would have avoided drawdowns exceeding 70%. Seasoned Bitcoin investors know that enduring entire bear markets without risk management rarely pays off.

Institutional investors, unlike retail investors, operate under risk mandates that require them to liquidate when losses exceed certain thresholds. Retail traders, by contrast, often absorb deep drawdowns. This institutional discipline could shorten future bear markets by accelerating the reset phase, while also dampening volatility—particularly as options markets now play a major role in Bitcoin’s price dynamics.

We don’t expect a downturn as deep as prior cycles, but technical and behavioral signals still matter. Managing exposure dynamically, not emotionally, remains essential. Readers may recall our “lines in the sand” at $68,000 (April 2024) and $92,000 (February 2025)—key protective levels. The $19.6 billion liquidation event two weeks ago was triggered as Bitcoin broke below major support zones, including $117,300 and $110,000–$112,000, which aligned with both the 21-week EMA and the short-term holder realized price. Historically, once Bitcoin slips below this realized price, liquidation pressure accelerates, and rebounds are often capped by breakeven selling.

If Bitcoin reclaims and holds above this 21-week threshold, traders should follow that trend until major resistance reappears. But as long as it stays below, a drift toward $100,000 remains likely—especially in a market susceptible to Trump’s self-negotiating, policy-on-the-fly remarks that swing sentiment short term.

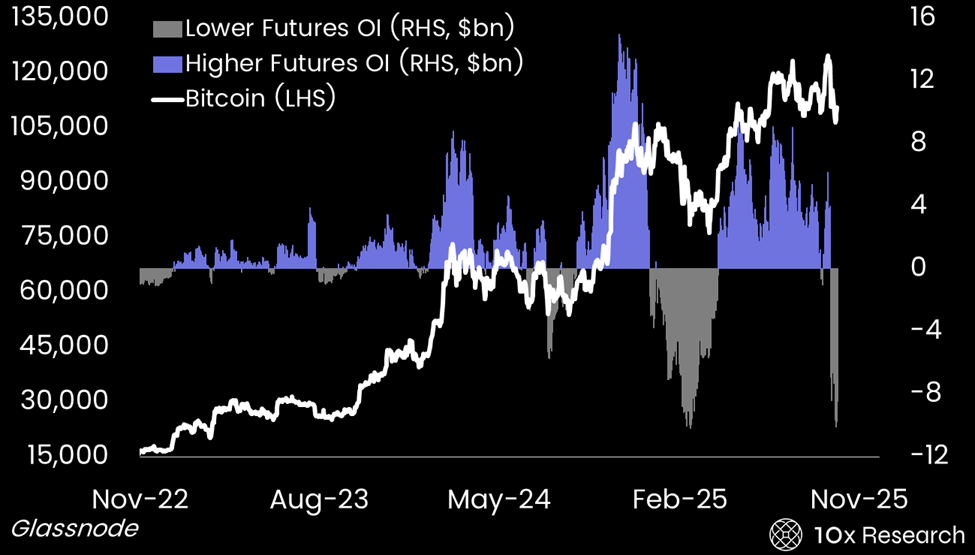

Speculative momentum has cooled, with futures open interest now below its 90-day moving average—a classic sign of consolidation. This caution signal intensifies when Bitcoin trades below the short-term holder's realized price (~155-day cost basis), a psychological stop-loss level where capitulation often begins. Failed rebounds from this level usually trigger renewed selling as trapped traders exit at breakeven. This likely explains why last night’s rally attempt was unable to gain traction.

Bitcoin (LHS) vs. Bitcoin Futures Open Interest Momentum (RHS)

Meanwhile, long-term holders are starting to move coins, as indicated by the Coin Days Destroyed metric, signaling profit-taking and distribution. Our momentum model, comparing the one-month and 90-day averages, confirms that Bitcoin is likely entering a consolidation phase.

A more reliable indicator of bigger market shifts is the realized capitalization-to-market capitalization ratio. When this ratio slows versus the prior year, it signals that new capital inflows are weakening. The initial bull wave faded in mid-2024, turned bearish by Q1 2025, and while it briefly flipped bullish in April 2025, momentum stayed weak—explaining the current range-bound behavior. Recent readings point to the early stages of a new bearish phase.

The Short-Term SOPR reinforces this view: profitability has eroded as recently moved coins are increasingly sold at or near a loss. Unlike past cycles with one dominant SOPR peak, this cycle saw three mini bull waves, each followed by fading momentum—evidence of exhaustion rather than expansion.

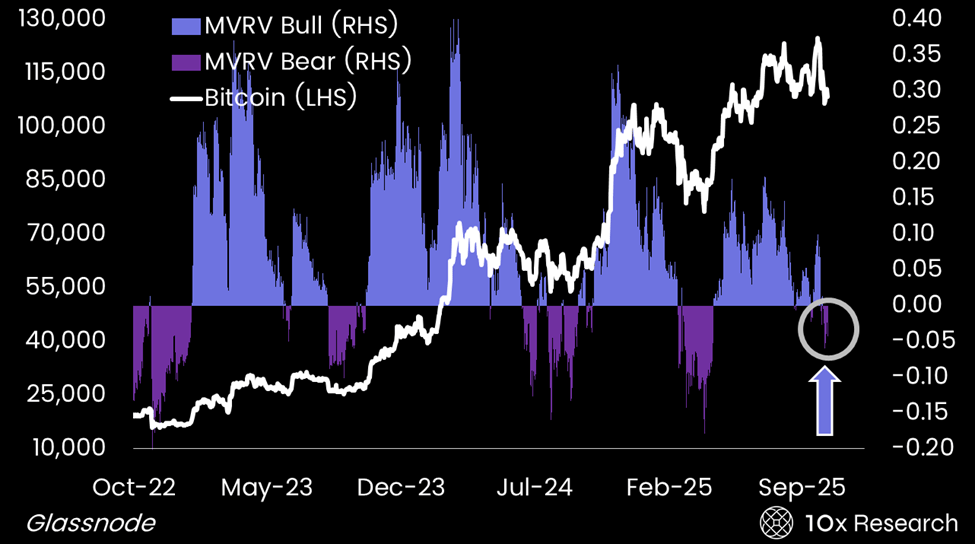

Similarly, the Market Value to Realized Value ratio indicates that while Bitcoin may appear undervalued, MVRV momentum remains negative, suggesting that buying pressure hasn’t yet returned. Until it does, the correction likely continues.

Bitcoin (LHS) vs. MVRV Momentum Indicator (RHS)

Historically, tactical lows occur when 15–20% of short-term holders are in loss; currently, it’s only 12%, implying room for further downside.

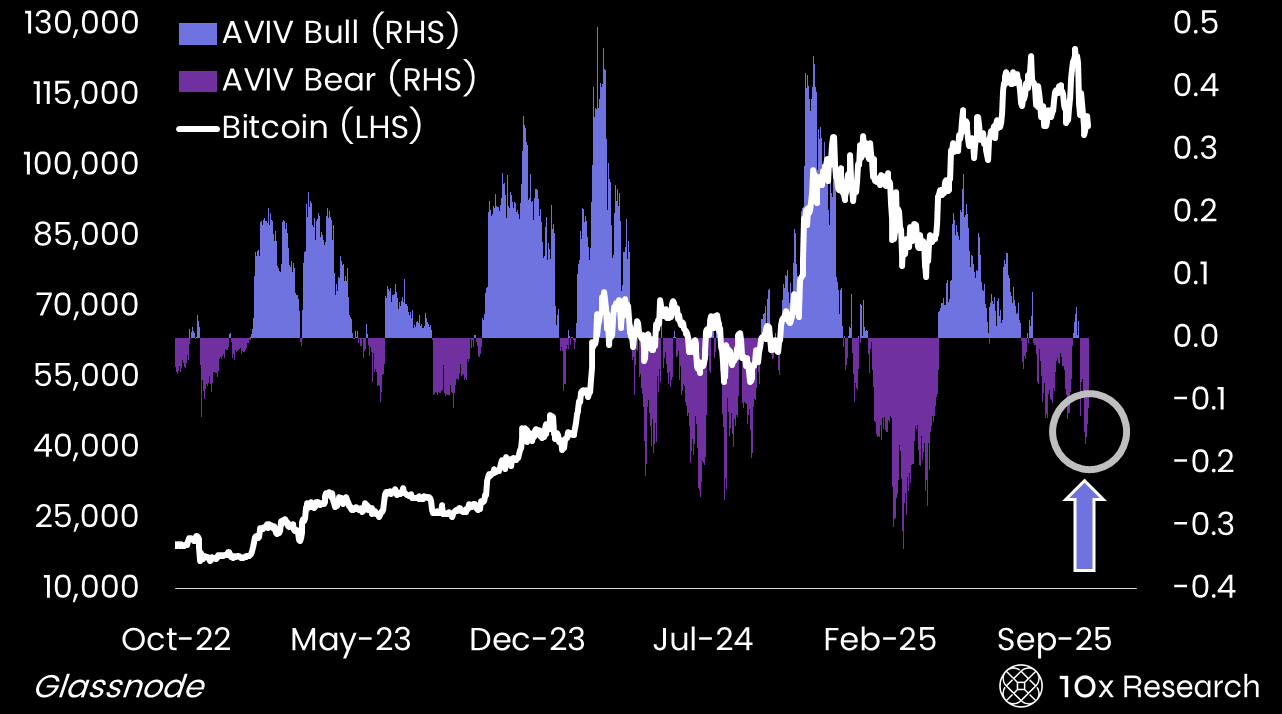

The True Market Mean Price (or Active Investor Price), which represents the average cost basis of coins purchased on secondary markets, still indicates that the market is broadly in profit. However, our 90-day momentum model suggests a decline in profitability, a bearish development. While this measure was bullish through 2023 and early 2024, recent readings suggest waning conviction and a shift toward sustained consolidation.

Bitcoin (LHS) vs. AVIV Momentum Indicator (RHS)

Still, as long as Bitcoin trades above the True Market Mean (around $81,000), the current move remains a ‘bear market correction’, not a full blown bear market. With the metric trending higher, a worst-case dip toward $85,000 could mark the low, while the first key downside target remains $100,000, given multiple bearish indicators and the break below the short-term realized holder level near $113,000.

Conclusion

Hence, despite supportive macro conditions, favorable seasonality, and a strong equity backdrop, many of the on-chain and tactical indicators we track have turned notably less bullish, if not outright bearish. Over the past few months, our strategy has focused on selling upside calls and downside puts, reflecting our view that Bitcoin would remain confined to a relatively narrow trading range, a view that has so far played out.

However, the risk of a larger short-term move is now rising. Traders should pay close attention to the signals from these indicators, as history shows they often distinguish those who preserve capital and buy the dip from those who end up hoping merely to break even. An initial move towards $100,000 still remains our base case with a break below $113,000 indicating that Bitcoin has entered, at least, a mini bear market as already indicated by various on-chain and other important tactical signals.