Why this report matters

Altcoins are quietly collapsing under the weight of $59 billion in token unlocks, yet few traders are paying attention. Retail interest has waned, volumes have plummeted, and the narratives that once drove hype have all but vanished. Meanwhile, Bitcoin continues to attract capital, with ETF inflows painting a stark contrast to the relentless outflows from altcoin ecosystems. Even the most celebrated meme coins are unraveling, leaving retail investors stuck at the top. But buried in the data are subtle signals—patterns that have historically preceded short-term rallies.

Main argument

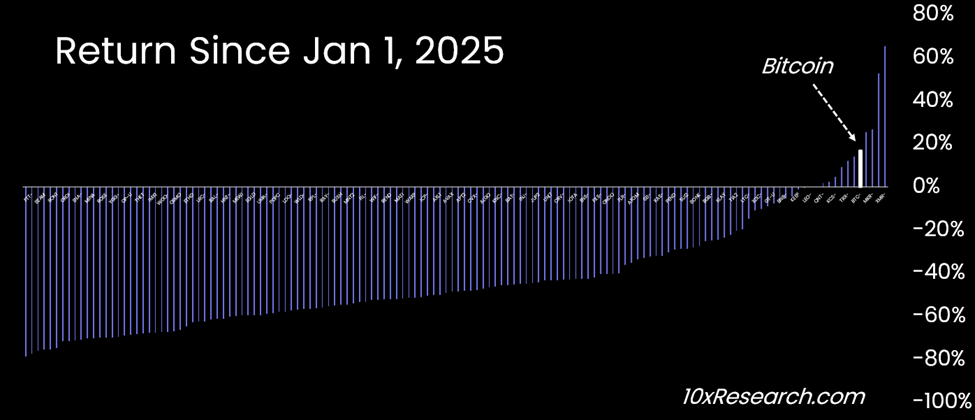

There are several reasons why altcoins are underperforming this cycle, and, with few exceptions, have resulted mainly in investors losing money. Since January 14, 2024, we’ve consistently recommended shorting altcoins while maintaining long exposure to Bitcoin. Year-to-date, Bitcoin is up 17%, while Solana and Ethereum have declined by 20% and 22%, respectively, meaning Bitcoin has outperformed them by roughly 37%. In other words, it’s been a highly effective long/short strategy.

Performance of 140 crypto currencies - year to date

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

UpgradeMost comprehensive, unbiased digital asset research for traders and institutions:

- Receive 2-4 concise, informative Market Updates reports per week.

- We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- --------------

- Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.