- 10x Market Update

- Posts

- Three Bitcoin/Crypto Catalysts Left This Week—Then What?

Three Bitcoin/Crypto Catalysts Left This Week—Then What?

Actionable Market Insights

Why this report matters

This Bitcoin bull market has been anything but smooth, driven by sudden catalysts such as Fed policy shifts, ETF approvals, and political momentum. But now, we’re approaching a moment where the biggest events on the calendar—corporate earnings, the White House digital asset report, and the FOMC meeting—are about to be behind us before everybody heads into the summer. With August and September historically weak for crypto, traders face a dilemma: chase the rally, or prepare for a pause?

Main argument

This fifth Bitcoin bull market (see Crypto Titans book) has been characterized by bursts of momentum and sudden pauses, rather than a steady, high Sharpe ratio climb. Each move has hinged on a clear catalyst: Fed rate expectations, Trump’s political traction, ETF breakthroughs, or regulatory interventions, such as the dismantling of crypto-friendly banks. That’s why staying laser-focused on macro triggers and reacting quickly to breakouts remains critical. In crypto, momentum is sparked by events, not driven by the calendar.

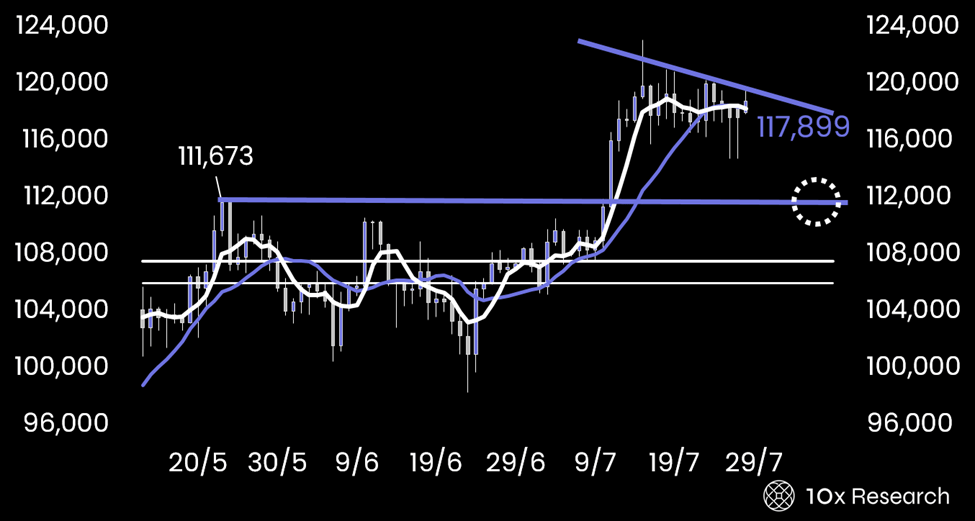

Bitcoin dropped to $115,000 heading into Friday’s option expiry—precisely the level we targeted a month ago when we sold the $115,000 strike July 26 call for a $1,560 premium (see report from June 24). At the time, Bitcoin was trading at $104,000, and a rally was widely dismissed by the market, making this a strong contrarian setup. The trade generated an 18% annualized yield in addition to Bitcoin’s price appreciation. We’ve already initiated a new trade ahead of the August month-end options expiry (see below).

Bitcoin: Retracement to $111,673 or a break above $120,000?

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.