- 10x Market Update

- Posts

- Prediction Markets: The 10 Strategies and 10 Golden Rules That Separate Arbitrage From Entertainment (Part 3 of 4)

Prediction Markets: The 10 Strategies and 10 Golden Rules That Separate Arbitrage From Entertainment (Part 3 of 4)

Actionable Market Insights

Prediction markets are exploding into the mainstream, but most participants still treat them like entertainment, not like a system that quietly rewards the few who understand structural edge. While retail chases long-shot narratives, disciplined traders harvest probability and time-decay, capturing outcomes that are not just likely, but mathematically inevitable. This report shows how those edges form. Here, the winners aren’t the loudest traders with the boldest predictions, they’re the quiet ones who understand microstructure, flow imbalances, and volatility decay.

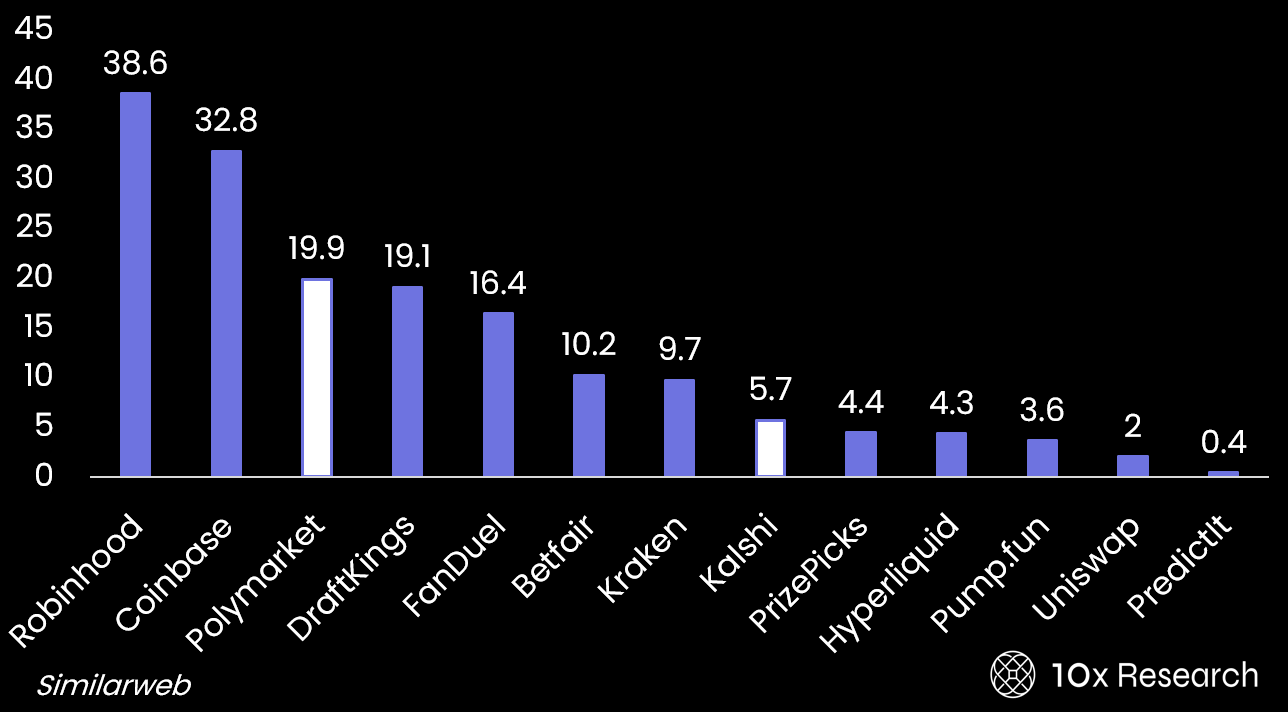

Visits in November (in millions) - Polymarket number 3

Part 1 (here) showed that prediction markets have reached a structural turning point: liquidity is scaling, regulatory clarity has finally arrived, and retail participation is accelerating just as professional desks position themselves to harvest spread, flow imbalance, and information asymmetry. It established the architecture, the liquidity map, the regulatory unlock, and the historical analogs that demonstrate a recurring truth: when new trading venues open, informed participants don’t chase narratives, they monetize those who do.

Part 2 (here) stripped away the myth of collective wisdom. Prediction markets are not guided by “the crowd,” but by a tiny, informed minority who price probability, hedge exposure, and extract premium from retail-driven longshots. Most users behave like sports bettors, trading narrative and novelty for discipline and expectancy, while a small cohort quietly profits from mispriced optimism and late-stage convergence dynamics.

Part 3 distills this into ten executable trading frameworks, presented as a set of golden rules, and details ten prediction market strategies ranked from low to high risk.

Part 4, publishing next, turns theory into execution: real contracts, real order flow, and exactly how we would position across Polymarket using the strategies introduced in Part 3.

Harvesting the zero probability spread (as explained yesterday)

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.