- 10x Market Update

- Posts

- Is Coinbase Running Too Hot After Its 88% Rally?

Is Coinbase Running Too Hot After Its 88% Rally?

Actionable Market Insights

Why this report matters

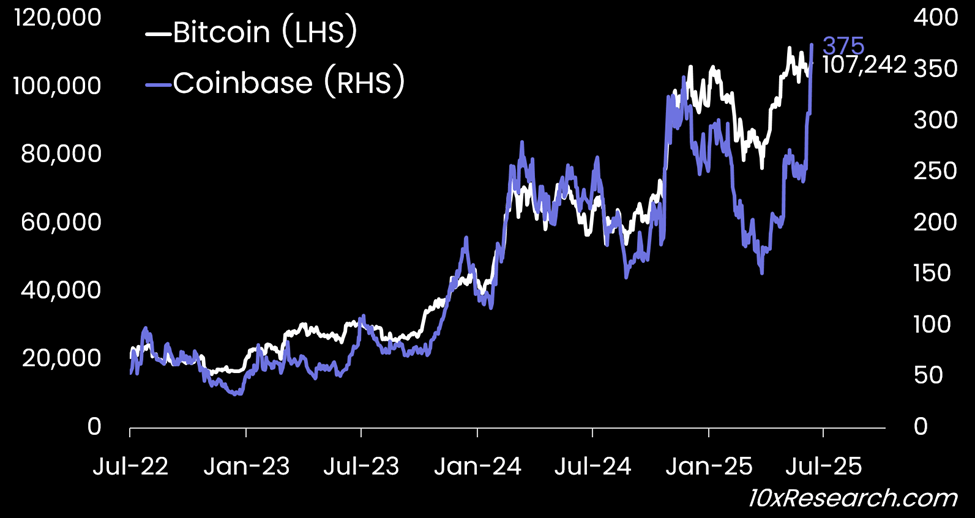

Coinbase has surged 88% since mid-May, far outpacing Bitcoin, trading volume, and nearly every crypto stock in its peer group. But do fundamentals still back this move, or are we entering a zone of overexcitement? Our latest analysis delves into valuation signals, retail inflows from Korea, and what is truly driving the disconnect between Coinbase and the broader cryptocurrency market. One simple regression model explains 75% of the stock’s price action, and it’s flashing a potential warning. Meanwhile, sentiment is cooling in other crypto favorites, such as Circle and KakaoPay.

Bitcoin (LHS) vs. Coinbase (RHS)

Main argument

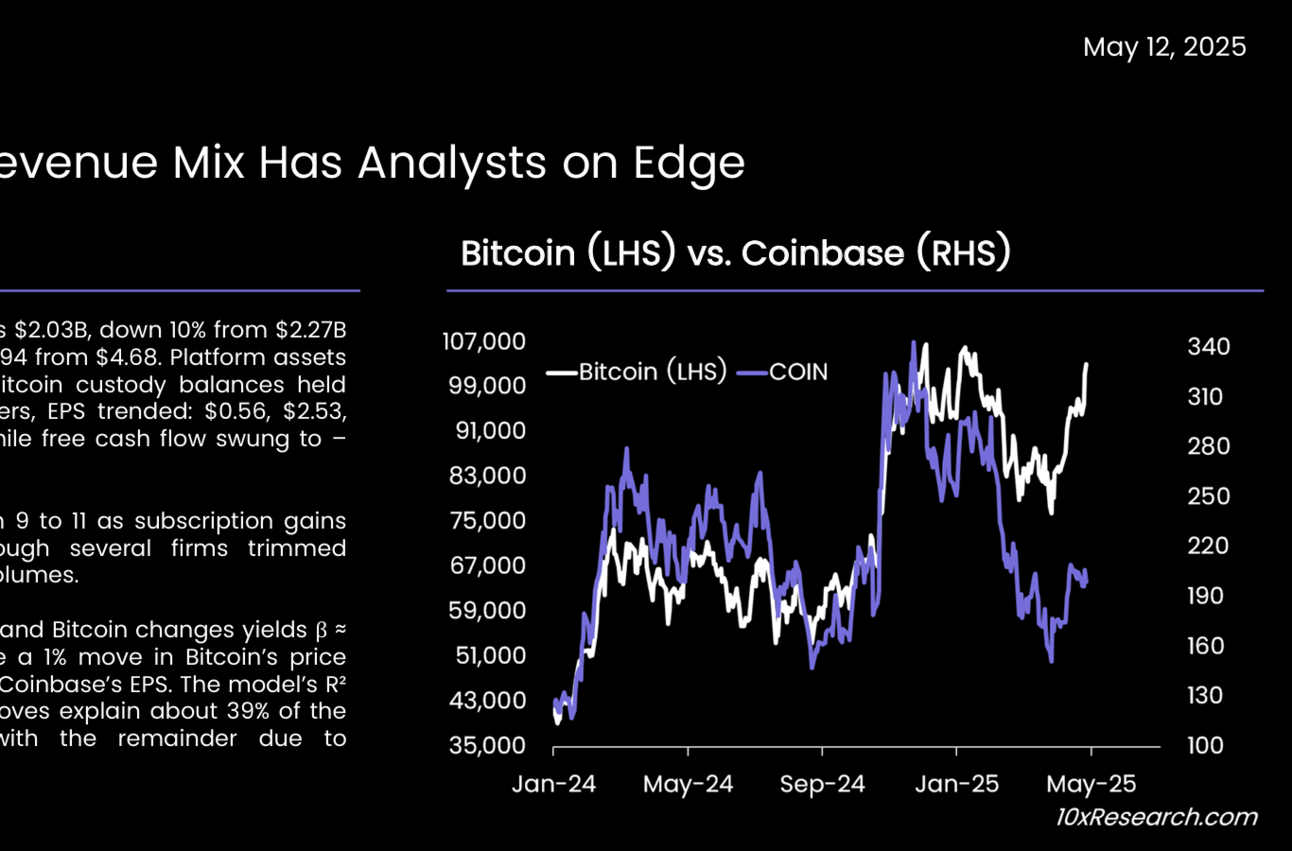

We’ve maintained a bullish view on Coinbase, with our valuation trigger aligning with its inclusion in the S&P 500, announced on May 19, when the stock was trading at $264. In our May 12 market report, we highlighted a significant divergence between Bitcoin and Coinbase’s share price, with COIN trading at $199 while Bitcoin stood at $102,971.

At the time, our regression model indicated that Coinbase was undervalued by 32%, near historical lows. Even in our June 8 update, the model still indicated that Coinbase was trading 18% below fair value, and we noted its strong positioning as a key beneficiary of Circle’s growing stablecoin business.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.