Summary

Global risk sentiment stabilized as equities, gold, and select crypto assets reflected diverging capital flows. In TradFi, U.S. equities remained resilient — AI and industrial leaders like Broadcom, TSMC, and Caterpillar lifted the S&P 500 and Nasdaq despite dollar softness and yield pressure. Gold hit fresh record highs on rising rate-cut expectations and safe-haven demand, while Treasury yields declined amid liquidity strain and concerns over bank credit losses.

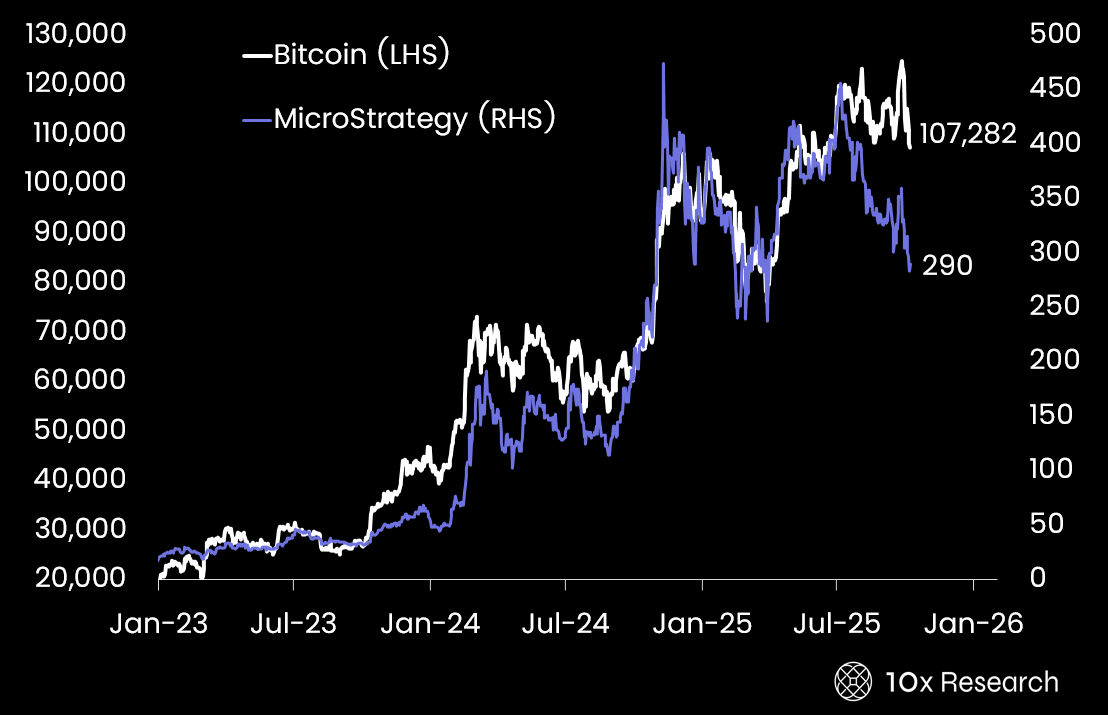

In crypto, Bitcoin sentiment was mixed — optimism over a UK-listed fund was offset by geopolitical tensions and regulatory seizures. Corporate proxies diverged: MicroStrategy faced dilution worries, while Galaxy Digital’s retail pivot and Coinbase’s India expansion showcased strategic diversification. Miners saw a split response, with AI-aligned firms like Bitdeer, Riot, and TeraWulf gaining attention, while debt-funded players such as Bitfarms and Core Scientific faced valuation and governance headwinds.

Across altcoins, performance was selective. MakerDAO and Ethena led DeFi gains on token migrations and ecosystem expansion. Ethereum and Solana showed renewed on-chain traction but struggled against short-term pressure. Ripple’s $1 billion acquisition underlined its move into institutional finance, while BNB, Dogecoin, and Cardano reflected renewed retail speculation ahead of ETF and upgrade catalysts. Tron, Avalanche, and Aptos maintained ecosystem momentum through integrations, institutional funding, and developer initiatives, underscoring how capital continues rotating into infrastructure- and utility-driven projects.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

UpgradeImportant Trading alerts and risk factor analysis.:

- Actionable market analysis that saves you hours.

- Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- Focused on Bitcoin and top crypto assets.

- Get 2–5 Reports per Week. Know More. Doubt Less.

- Turning market insights into confident action.