Why this report matters

Bitcoin is wrestling with a familiar resistance level, and the market has quietly rejected the rebound attempt. Volatility has collapsed, ETF flows are underwhelming, and yet a deeper shift in positioning is hiding beneath the surface. Seasonal tailwinds should be supportive, but the data shows December isn’t the bullish month most traders think it is. Meanwhile, global rate dynamics and crypto-specific risks are starting to influence price action in ways the market hasn’t fully processed.

Main argument

Bitcoin has slipped only 1.8% over the past week, and the short straddle we highlighted in last week’s Kickoff report, selling the $70,000 put and $100,000 call for the December 2025 expiry, has already fallen in value from $2,279 to $1,036. We still expect Bitcoin to trade within the $70,000–$100,000 range through year-end, but initiating the same position today offers a much lower annualized yield of roughly 12%, compared with 31% a week ago. The reason is straightforward: implied volatility has collapsed from last week’s elevated levels, reducing the premium available to sellers.

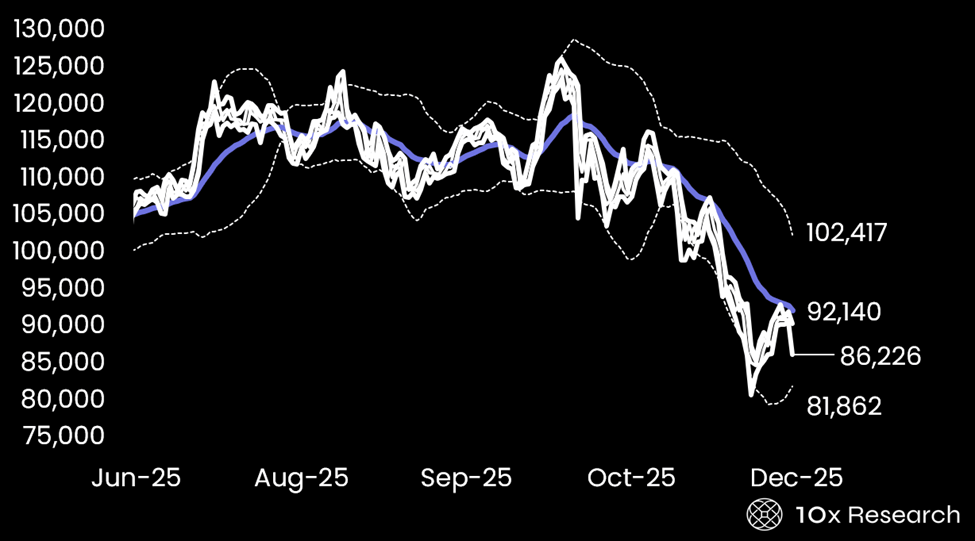

Bitcoin - failed at the $92,000 resistance level

As we wrote last week, “key resistance at $90,000–$92,000 and $99,000–$101,000 remains intact, and we expect this bounce to fade in the days ahead or into the FOMC meeting. Even if the Fed cuts in December, it is likely to be a hawkish cut, making this rally more of a short-term, oversold rebound amid extreme fear than the start of a sustainable V-shaped recovery” (here).

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

UpgradeImportant Trading alerts and risk factor analysis.:

- Actionable market analysis that saves you hours.

- Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- Focused on Bitcoin and top crypto assets.

- Get 2–5 Reports per Week. Know More. Doubt Less.

- Turning market insights into confident action.