- 10x Market Update

- Posts

- Bitcoin Dominance Surges - So Why Are These Two Indicators Flashing Bear Market?

Bitcoin Dominance Surges - So Why Are These Two Indicators Flashing Bear Market?

Actionable Market Insights

Why this report matters

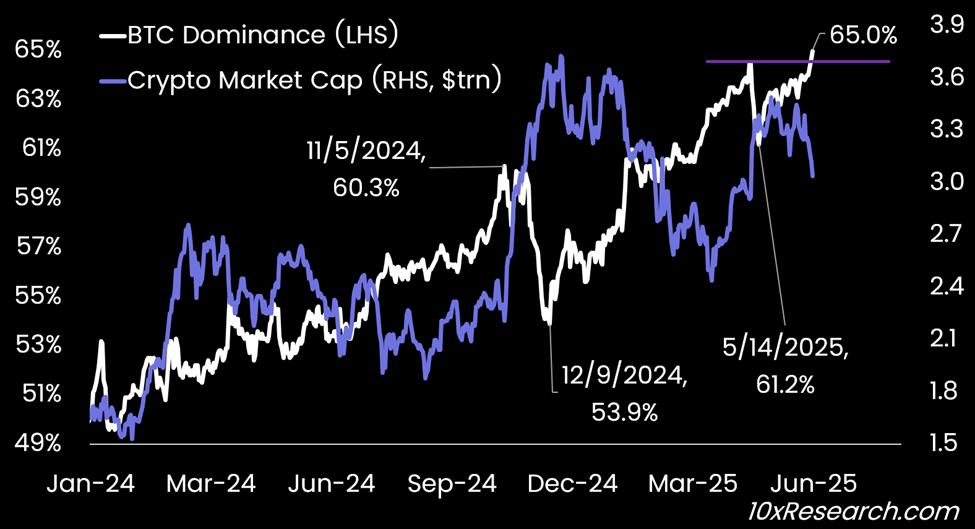

While Bitcoin dominance has surged to a new cycle high, two critical indicators are flashing early signs of broader market stress. Ethereum, once riding a wave of ETF optimism, is now unraveling under the weight of overleveraged futures positions. See June 5 report: Is Wall Street Really Warming Up to Ethereum? The Truth Behind ETH ETF Inflows (here).

Bitcoin Dominance (LHS, %) vs. Crypto Market Cap (RHS, $ trillions)

Meanwhile, (market-based) liquidity, a silent driver of every rally, has quietly started to dry up. Even stablecoin flows, often overlooked, are painting a telling picture as we head into summer. Some of the market’s biggest buyers are pulling back, and key technical levels are now being tested. What’s driving this stall—and what happens if support doesn’t hold?

Main argument

As anticipated, both Bitcoin and Ethereum are undergoing corrections, with each signaling a shift from bullish to bearish trends. In our report heading into the weekend (here), we highlighted Ethereum’s vulnerability to breaking below $2,420—a scenario that is now playing out. However, two critical indicators are on the verge of flipping bearish for Bitcoin—an inflection point that could have broad implications across the entire crypto market, including Ethereum.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.