- 10x Market Update

- Posts

- Billions Keep Pouring Into Crypto—So Why Could Today Mark a Major Reversal?

Billions Keep Pouring Into Crypto—So Why Could Today Mark a Major Reversal?

Actionable Market Insights

Why this report matters

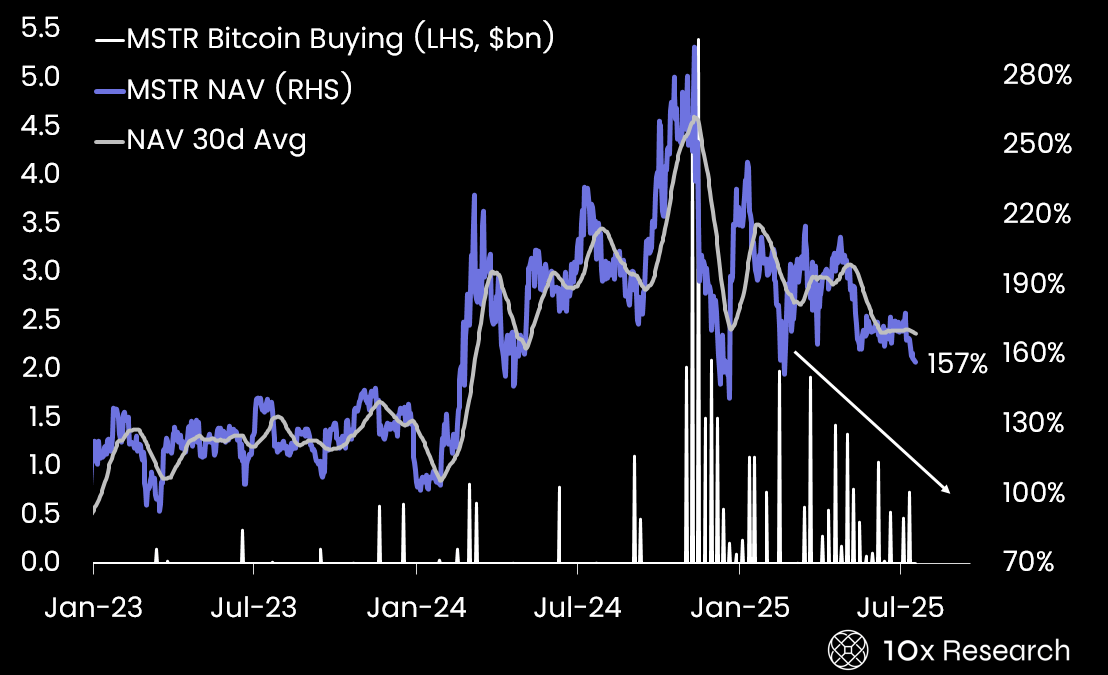

Crypto markets appear strong on the surface, but not everything is as it seems. Treasury-backed inflows are making headlines, and Ethereum ETF demand is accelerating—but under the hood, cracks may be forming. Volumes are shifting, funding dynamics are changing, and NAV premiums are quietly retreating.

While institutional names dominate the narrative, retail may be unknowingly stepping into a different game. There’s a key reason MicroStrategy isn’t raising cash through new common share offerings—and it’s linked to a dynamic that has historically fueled Bitcoin’s rallies. Our real-time indicators now suggest a high probability that today could set the tone for the remainder of the summer.

MicroStrategy’s 30-day capital raising (LHS, $bn) vs. MSTR NAV (RHS)

In the analysis below, we break down the signals that investors should watch closely, as the implications could be significant not just for Bitcoin but also for Ethereum and the broader altcoin market.

Main argument

Four Ethereum treasury companies now hold significant ETH reserves: Bitmine leads with $2.2 billion, followed by Sharplink at $1.7 billion, Bit Digital with $467 million, and BTCS holding $216 million. Together, public companies have amassed roughly $5 billion in Ethereum, representing about 1.06% of total ETH in circulation.

The Ether Machine is expected to list with an additional $1.6 billion in market cap, potentially expanding corporate ETH holdings further. While the SPAC vehicle facilitating the listing initially surged 50% on the announcement, it has since retraced most of that move, highlighting both early excitement and market caution.

For retail investors, investing in Ethereum treasury companies requires close attention to the details. Institutional investors often participate in private placements (PIPEs) days or even weeks before public announcements, usually at significantly lower valuations.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.