The GENIUS Act complements a regulatory trifecta, alongside the SEC's approval of a Bitcoin ETF and the FASB’s fair-value crypto accounting rules, by establishing a clear legal foundation for stablecoins. This unlocks institutional adoption of tokenized dollars as corporates gain accounting clarity and Wall Street embraces digital assets.

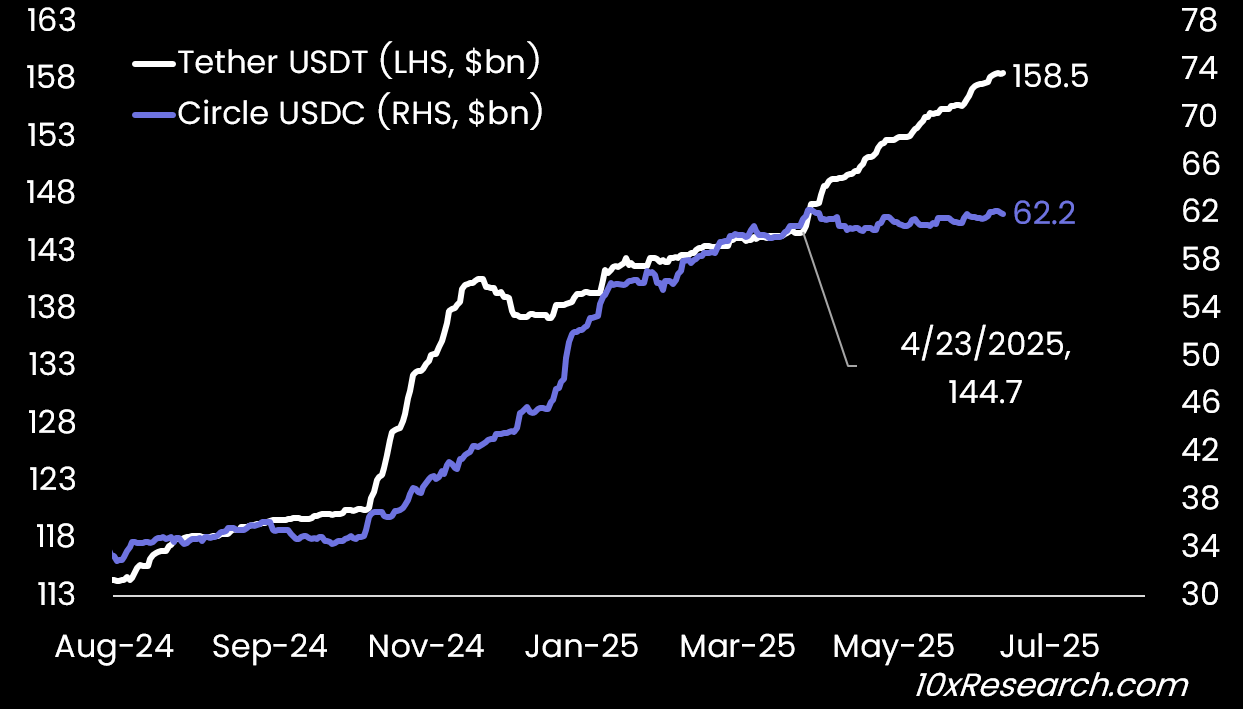

Stablecoin issuance has notably increased since early November 2024

On December 13, 2023, the FASB issued a landmark accounting standard mandating fair value treatment for certain crypto assets—a pivotal move toward greater transparency and financial mainstreaming. Though the rule took effect on December 15, 2024, it has triggered a wave of corporate treasury adoption heading in 2025. The SEC's approval of Bitcoin Spot ETFs on January 10, 2024, marked Wall Street’s green light to offer direct exposure to Bitcoin through regulated products, unlocking institutional capital and legitimizing crypto as an investable asset class. The GENIUS Act is pivotal because it creates the first federal framework for stablecoins in the U.S., legitimizing dollar-backed tokens and enabling regulated entities to issue regulated digital dollars at scale.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

UpgradeMost comprehensive, unbiased digital asset research for traders and institutions:

- Receive 2-4 concise, informative Market Updates reports per week.

- We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- --------------

- Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.