- 10x Market Update

- Posts

- Why Ethereum’s Rally Stalled: Technicalities or Just Technicals?

Why Ethereum’s Rally Stalled: Technicalities or Just Technicals?

Actionable Market Insights

Why this report matters

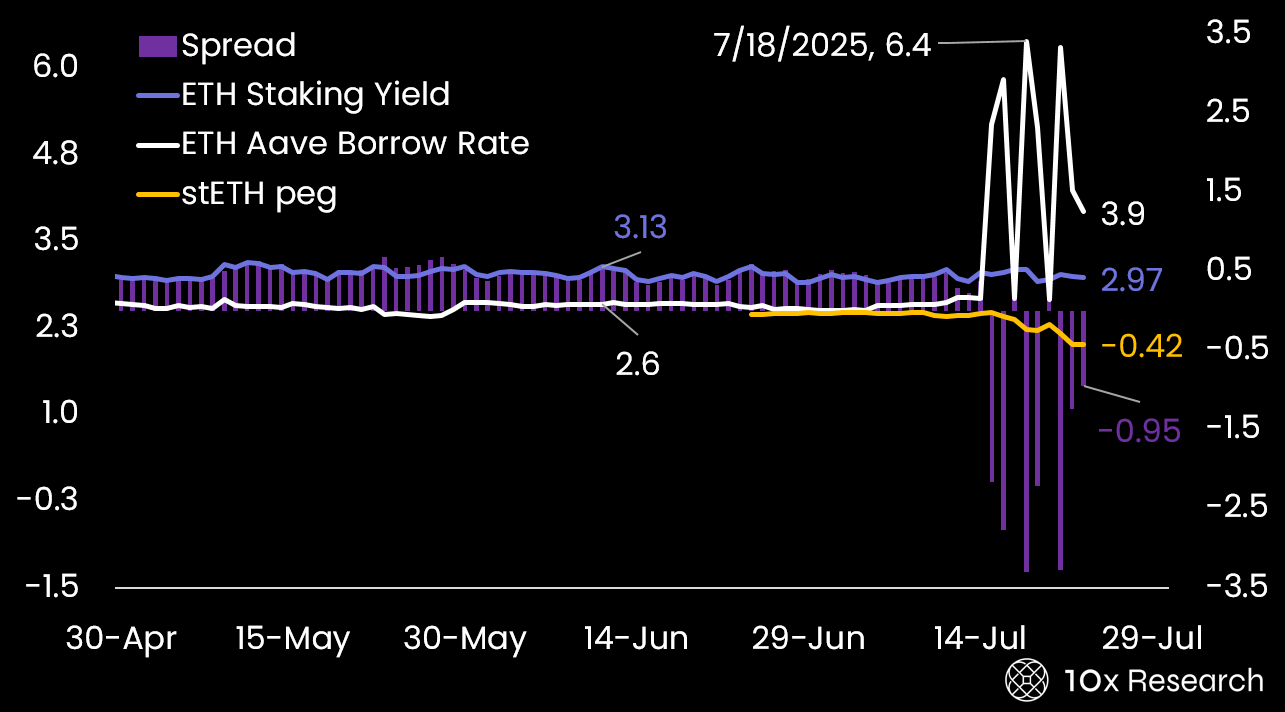

Ethereum's recent rally wasn't just about momentum—it was fueled by one of DeFi's most leveraged trades unraveling in real time. As borrowing costs surged and key players pulled liquidity, a cascading unwind began, destabilizing the stETH peg and pressuring ETH’s price action. Technical indicators flashed extreme overbought levels just as retail euphoria reached its peak, creating the perfect storm.

Borrowing dislocations for Ethereum (LHS) as spreads turn negative (RHS)

Meanwhile, Bitcoin remains stuck below its $122,000 ceiling, suggesting a potential shift in volatility regime. But with funding rates repricing lower and altcoin strength fading, are we heading into a deeper consolidation, or just the calm before another breakout? The interplay of on-chain mechanics, ETF flow dynamics, and macro signals could set the stage for what comes next.

Main argument

We identified the breakout in Ethereum and Ripple (XRP) early in our July 9 Trading Signals report (here). We turned bearish on both by July 22 (here), as prices became significantly overbought and approached major multi-year resistance levels. Ethereum, in particular, had rallied back to the key highs of May and December 2024 and was testing the upper boundary of a long-term down-trending wedge dating back to 2021, converging with multiple 2024 peak levels.

At the same time, technical reversal signals, including RSI and Stochastics, reached some of the most overbought readings ever recorded for Ethereum, underscoring the likelihood of a pullback. Recognizing these stretched conditions ahead of time was essential. From the July 9 signal, Ethereum gained +44%, but since our bearish call on July 22, it has already declined by -4%. But is this the dip to buy or the beginning of a deeper pull-back?

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.