- 10x Market Update

- Posts

- Why Bitcoin’s Biggest Buyers Are Still Being Outsold

Why Bitcoin’s Biggest Buyers Are Still Being Outsold

Actionable Market Insights

Why this report matters

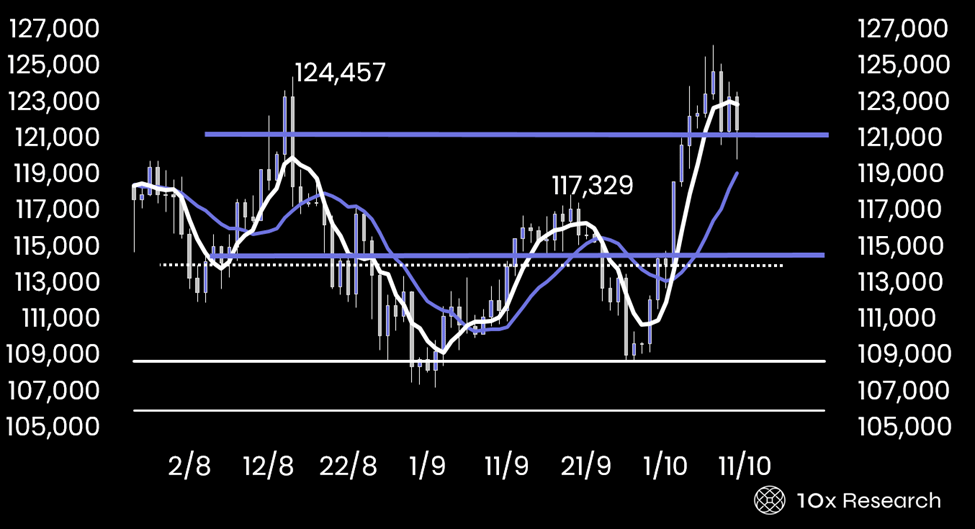

Bitcoin is up 7% in October, perfectly matching its seasonal pattern — but this time, the rally feels different. Despite trading near all-time highs, momentum is fading, and what once looked like a clean breakout now sits in no-man's-land. Beneath the surface, the story unfolds differently: institutional whales are buying aggressively, while early adopters quietly sell into strength.

Macro signals, too, have flipped neutral. With option traders turning defensive and volatility refusing to compress, now is the time for traders and investors to revisit our disciplined accumulation strategies for Bitcoin. The market is no longer a one-way trade — the growing influence of institutional players has made positioning more nuanced, rewarding those who accumulate strategically during periods of consolidation rather than chasing momentum. (see our prior report — “Missed the Bitcoin Rally? Now Having FOMO? Four Smart Trades to Still Get Involved”).

Bitcoin - key technical levels

Main argument

Bitcoin is up 7% so far in October, broadly in line with its typical seasonal pattern. While the move to $125,000 aligns with the cycle high we projected in our July 2023 report, the market landscape has changed dramatically since then. Despite trading only a few percent below its all-time highs, many investors are frustrated by the rally’s recent loss of momentum.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.