- 10x Market Update

- Posts

- Where This Bitcoin Rally Likely Fades and Where We Reload for the Next Cycle

Where This Bitcoin Rally Likely Fades and Where We Reload for the Next Cycle

Actionable Market Insights

Why this report matters

Bitcoin just slipped into a zone where the average active investor’s profit margin is razor thin, and history shows that’s when emotions start replacing discipline. Our latest analysis breaks down why this matters now, not using price predictions, but by tracking where real capital is actually positioned in the market. A key on-chain metric has only just rolled over, and what usually happens next is both counterintuitive and painful for late bulls.

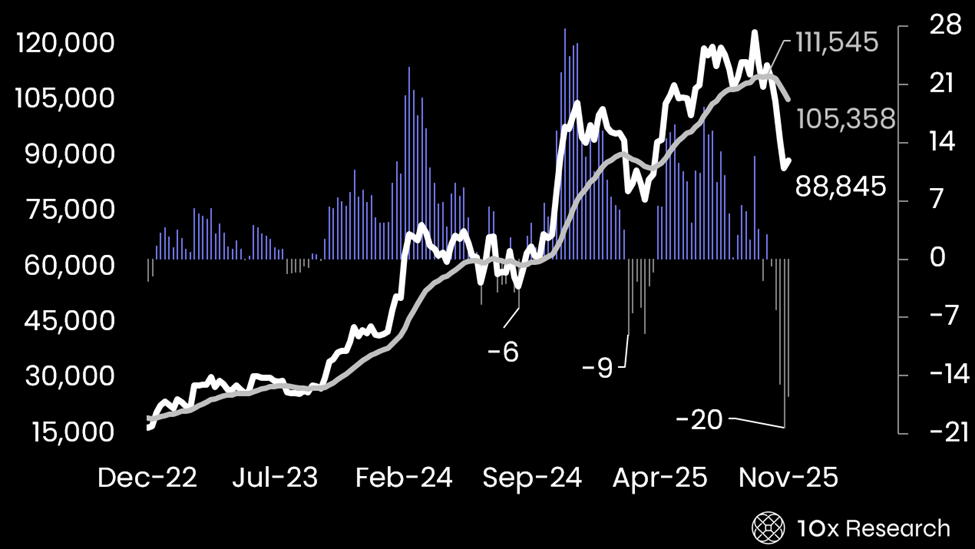

Below, we outline how we are positioning around this potential mini-rebound, including the levels where we expect the move to exhaust. More importantly, we also highlight the downside zones where longer-term investors may consider re-entering, after reducing exposure around the $111,545 area, a decision that protected roughly $23,000 of profit per Bitcoin, which can eventually be redeployed at more favorable levels.

Bitcoin (LHS) vs. area to cut all long exposure (ice wall cracking report )

Main argument

The True Market Mean Price, also known as the Active-Investor Price, estimates the average cost basis of coins acquired on secondary markets, meaning coins that have actually changed hands rather than remain dormant from mining or long-term holding. By giving more weight to recently active coins, it reflects where the current cohort of market participants is financially exposed, making it a proper gauge for identifying support, resistance, and aggregate profit/loss conditions.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.