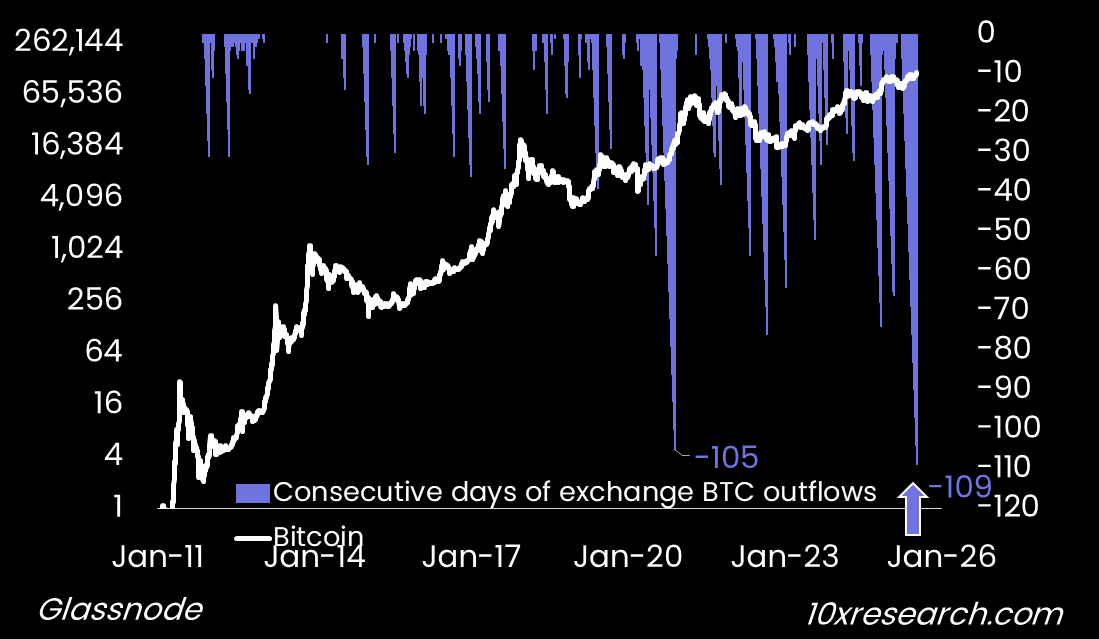

Bitcoin just posted its longest-ever streak of exchange outflows—surpassing the 2020 setup that preceded a 200% rally. Meanwhile, traders are bracing for this week’s CPI report, which could quietly tip the scales toward a September Fed rate cut.

Crypto Week is underway in Washington, with pivotal legislation on stablecoins and CBDCs up for a vote—potentially reshaping the regulatory landscape. Add to that a high-stakes policy report due July 22, which could lay the groundwork for a federal digital asset strategy. None of this is noise—it’s a convergence of signals most investors aren’t watching closely enough. We break down what it all means—and what comes next.

There’s a strong chance the upcoming July 15 U.S. CPI report either disappoints again or proves to be a non-event. If inflation comes in below expectations, it could increase the likelihood of a September rate cut—an outcome that would be decidedly bullish for Bitcoin.

Only three crypto exchanges still hold more than 150,000 Bitcoin each. What does it mean for the Bitcoin price? We explain below.

109 consecutive days of BTC balances leaving exchanges (RHS), longest ever

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

UpgradeMost comprehensive, unbiased digital asset research for traders and institutions:

- Receive 2-4 concise, informative Market Updates reports per week.

- We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- --------------

- Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.