Why this report matters

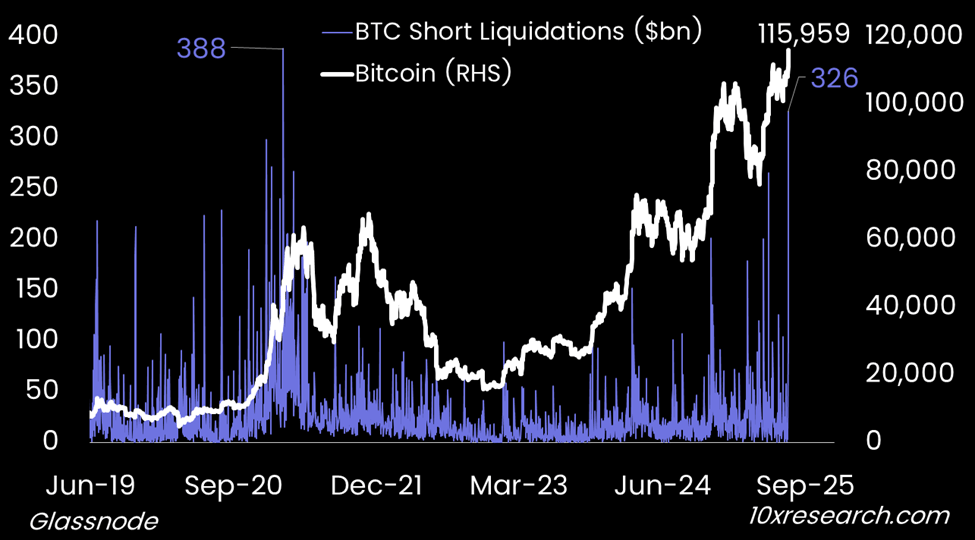

Bitcoin just hit our July price target ($116,000)—but what’s unfolding beneath the surface is even more critical. A fresh uptrend signal has triggered, catching many traders off guard and prompting the highest liquidations since 2021. ETF inflows are accelerating, funding rates have spiked, and volatility metrics are flashing setups not seen in months. Meanwhile, trend-following funds are stepping in, potentially overpowering more cautious, discretionary players. But here’s what most aren’t seeing: the structure of the rally, the silent shifts in positioning, and the overlooked signals that point to where Bitcoin might go next.

Bitcoin Short Liquidations (LHS, $ million) are at their highest since 2021

Main argument

Bitcoin has now reached our July price target of $116,000, a level we projected based on seasonal trends that indicated a 9% rally (here). While we initially anticipated a broader summer consolidation, our stance turned decisively more bullish over the past two weeks as upside positioning remained sparse, creating the conditions for a sharp move higher. A fresh trading signal, triggered by Bitcoin making a new short-term high, suggests the rally may have further to run. Historically, similar signals have delivered a median gain of +20%, with 6 out of 10 instances producing positive returns. If this pattern holds, Bitcoin could climb as high as $133,000 by September (here).

In our June 30 report, “Why Bitcoin Traders Are Quietly Rotating From Puts to Calls,” we wrote: “While Bitcoin may seem range-bound on the surface, underlying pressures are building. Volatility is compressing, institutional flows are diverging, and the options market is sending signals that traders can’t ignore.

Bitcoin ETF flows - see yesterday’s report (here)

With steady ETF inflows, a more dovish Fed, and reduced tariff risks, the macro landscape is shifting faster than many realize. The recent options expiry may have removed some of the constraints that have kept Bitcoin in a tight range, as traders shift from buying puts to selling calls. This repositioning appears to be recalibrating Bitcoin’s center of gravity—softening upside resistance and setting the stage for a more directional, albeit gradual, move higher.”

At the time, Bitcoin was trading around $107,000—nearly 10% lower than its current value, which caught many traders off guard. Implied volatility had fallen to its lowest levels since the brief lull in summer 2023, allowing traders to buy upside convexity at relatively low premiums.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

UpgradeMost comprehensive, unbiased digital asset research for traders and institutions:

- Receive 2-4 concise, informative Market Updates reports per week.

- We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- --------------

- Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.