- 10x Market Update

- Posts

- The +119% Crypto Stocks Rally That Could Reshape the U.S. Stock Market Sectors

The +119% Crypto Stocks Rally That Could Reshape the U.S. Stock Market Sectors

Actionable Market Insights

Why this report matters

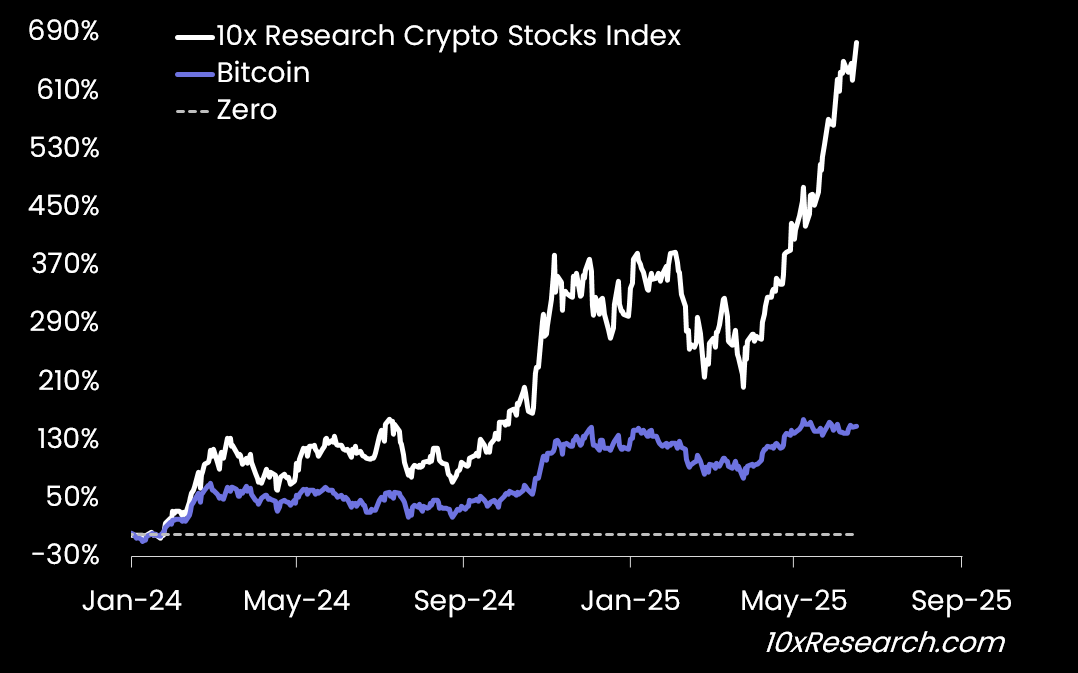

Crypto equities are up +119% year-to-date—outpacing Bitcoin and nearly every major asset class. Behind the headlines, a powerful shift is unfolding as Wall Street quietly backs a new wave of digital asset companies. From IPO pipelines to covered call strategies, the infrastructure is being built for something bigger than another bull run. This isn’t just about crypto—it’s about a potential new sector emerging within the S&P 500. Volatility is declining, capital is shifting, and the traditional financial system is beginning to take notice.

10x Research Crypto Stocks Index: +677% since January 2024

Main argument

One of our core themes for 2025 is that Wall Street has a strong incentive to keep Bitcoin prices elevated, as over $100 billion in crypto-related IPOs are preparing to enter public markets. Circle, for example, projected a $5 billion valuation in May 2025. Yet, its market cap has already reached $41 billion, with shares trading around $180—more than double the $80 price target set by analysts at J.P. Morgan and Goldman Sachs.

As Wall Street begins to cover and promote these crypto equities, they—and the companies that follow—will increasingly become part of institutional portfolios. While 2024 was defined by Bitcoin ETF inflows, 2025 is shaping up to be the year of crypto equities.

This includes not only the wave of IPOs expected to follow Circle’s momentum, but also already-listed crypto-related stocks—from miners, to diversified firms like Coinbase and Galaxy, to treasury-heavy companies such as MicroStrategy and Metaplanet. Even Robinhood is part of this broader crypto equity narrative, with 30% of its revenue tied to crypto. This figure could rise further as it begins offering tokenized stocks in Europe.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.