- 10x Market Update

- Posts

- Revising Our Bitcoin 2025 Year-End Target: Data-Driven and Inflow-Based

Revising Our Bitcoin 2025 Year-End Target: Data-Driven and Inflow-Based

Actionable Market Insights

Save 60% + Extra 10% OFF Token2049 SG—Only 1 Day Left! 🔥

Join us at Token2049 for another 10x Research’s exclusive side event—your prime opportunity to network with fellow traders!

Get your Token2049 conference tickets with an extra 10% off

Why this report matters

Bitcoin just rallied on one of the most catalyst-heavy weeks of the year, from a $5 trillion debt ceiling hike to panic buying by Mega Whales. But beneath the headlines, something more structural is unfolding. Capital inflows in 2025 are tracking just below record pace, and with Bitcoin’s market cap now massive, only real money moves the needle. Our regression model reveals a precise relationship between inflows and price, and this year’s data suggests a target that few are discussing.

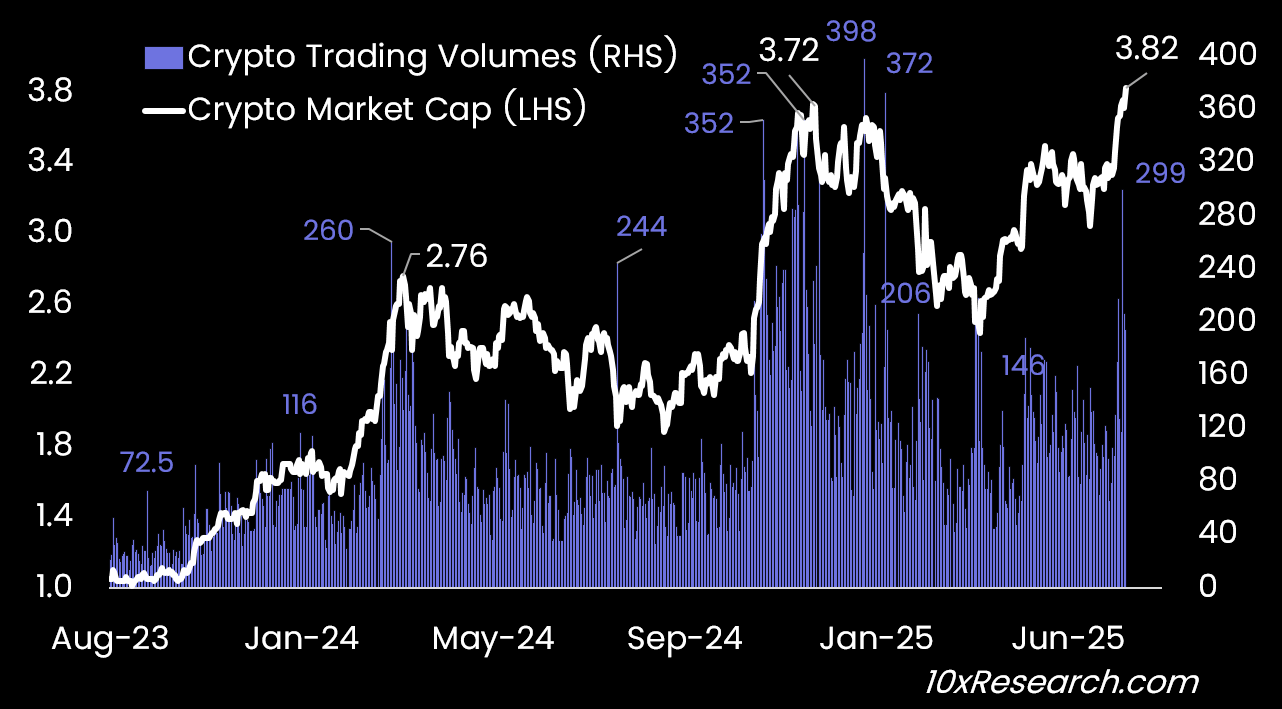

Crypto Market Cap has reached a new cycle high at $3.82 trillion

Main argument

On December 16, 2024, we initially projected a 2025 year-end Bitcoin target of $160,000, which we later refined to a target range of $140,000 to $160,000 in our early 2025 outlook. Now, with greater clarity on actual capital inflows into the Bitcoin network, we can update that estimate using annualized data. This allows us to provide a more realistic and data-backed year-end price target, grounded in observable market dynamics.

Forecasting Bitcoin price targets is inherently challenging, given the potential for rapid, momentum-driven moves. That said, our track record includes several out-of-consensus calls that proved highly accurate. We called the bottom in October 2022 and projected a surge to $63,160 into the 2024 halving—Bitcoin traded at $63,491 on the halving day.

In January 2023, we predicted a year-end target of $45,000, which closely matched the final price of $43,613. Our January 2024 forecast of $70,000 for year-end was also on track—until Trump’s election changed the macro landscape. Now that Bitcoin is breaking into new all-time highs, traditional cycle models offer less guidance; what matters most is the scale and trajectory of real money inflows into the network. So where will Bitcoin finish this year?

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.

.png)