- 10x Market Update

- Posts

- Is Tom Lee’s Bitmine Team Really Collecting $157 Million a Year?

Is Tom Lee’s Bitmine Team Really Collecting $157 Million a Year?

Actionable Market Insights

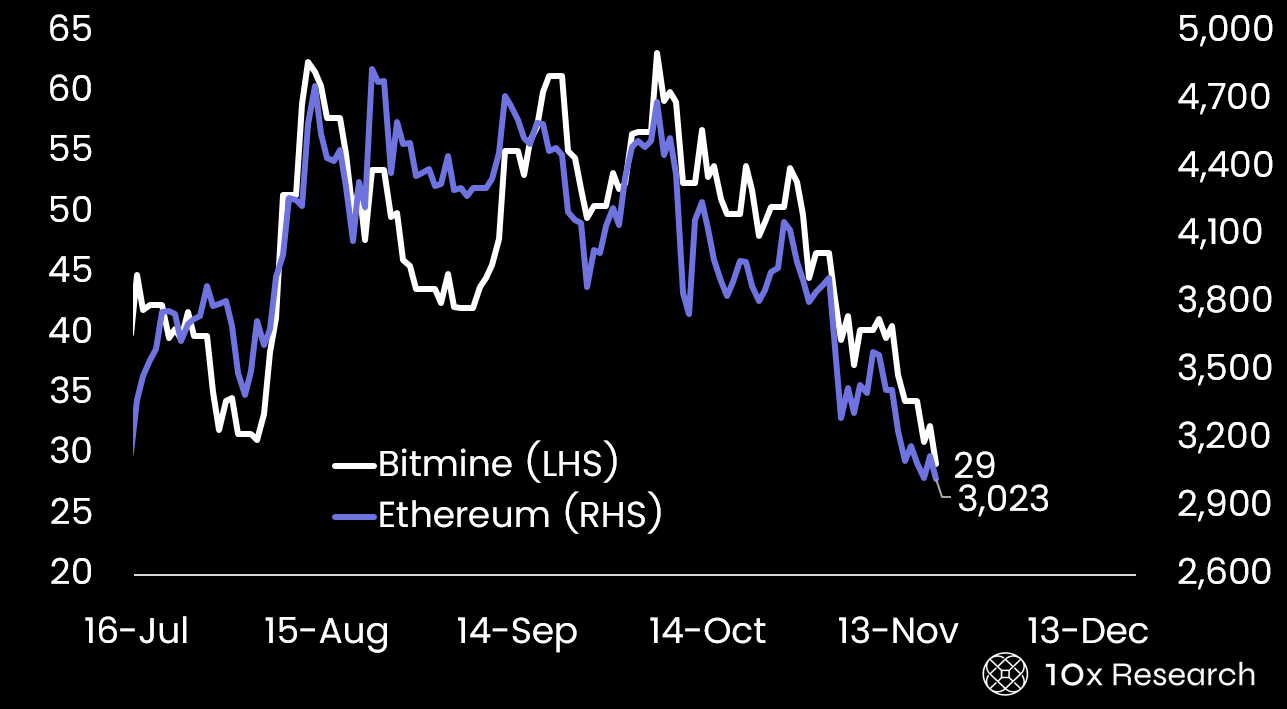

MicroStrategy investors have already absorbed roughly $20 billion in net asset value (NAV) compression (losses) since the company began buying Bitcoin, with most of that NAV accumulated at unfavorable prices in November/December 2024. Bitmine is now down more than $1,000 per ETH, implying about $3.7 billion in unrealized losses before even accounting for the hefty NAV premium public-market investors paid on top. Treasury companies will face a hard reality: attracting new retail investors becomes nearly impossible when existing shareholders are sitting on billions in losses.

Bitmine (LHS) vs. Ethereum (RHS)

When NAV rises, “old” shareholders benefit; when it falls, the damage compounds, a dynamic DAT investors often underestimate. When the premium inevitably shrinks to zero, as it is doing now, investors find themselves trapped in the structure, unable to get out without significant damage, a true Hotel California scenario.

Unlike ETFs, which trade tightly around NAV and whose returns reflect mainly the underlying crypto, DATs layer on complex, opaque, and often hedge-fund-like fee structures that can quietly erode returns. Many investors remain unaware that these embedded costs far exceed the 0.25% management fee charged by BlackRock’s Bitcoin and Ethereum ETFs. And with BlackRock now seeking approval to stake ETH in its ETF, offering a low-cost source of yield, the economics of DATs are likely to face increasing scrutiny.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.