- 10x Market Update

- Posts

- Is the Bitcoin Cycle Still a Reliable Bear-Market Signal?

Is the Bitcoin Cycle Still a Reliable Bear-Market Signal?

Actionable Market Insights

Why this report matters

The two most essential questions in Bitcoin today, whether the four-year cycle is still relevant and whether we are in a bear market, have effectively merged into one, and the answer carries enormous implications for every participant in the crypto industry. On October 16, 2025, we published our strategy report “What History Says about How This Bull Market Ends,” noting that while past Bitcoin bull markets often ended when regulatory pressure intensified, the SEC’s approval of Bitcoin ETFs removed that traditional overhang as a likely trigger. Instead, we identified four conditions that could mark a cycle peak, and three of those four can now be reasonably argued to have been present.

Main argument

Bitcoin’s four-year cycle is one of the most discussed ideas in the market. Yet, very few investors actually position around it, greed inevitably takes over, no one wants to sell too early, and everyone convinces themselves that “this time is different.” We have backtested multiple frameworks, studied every major cycle theory, and even developed our own models.

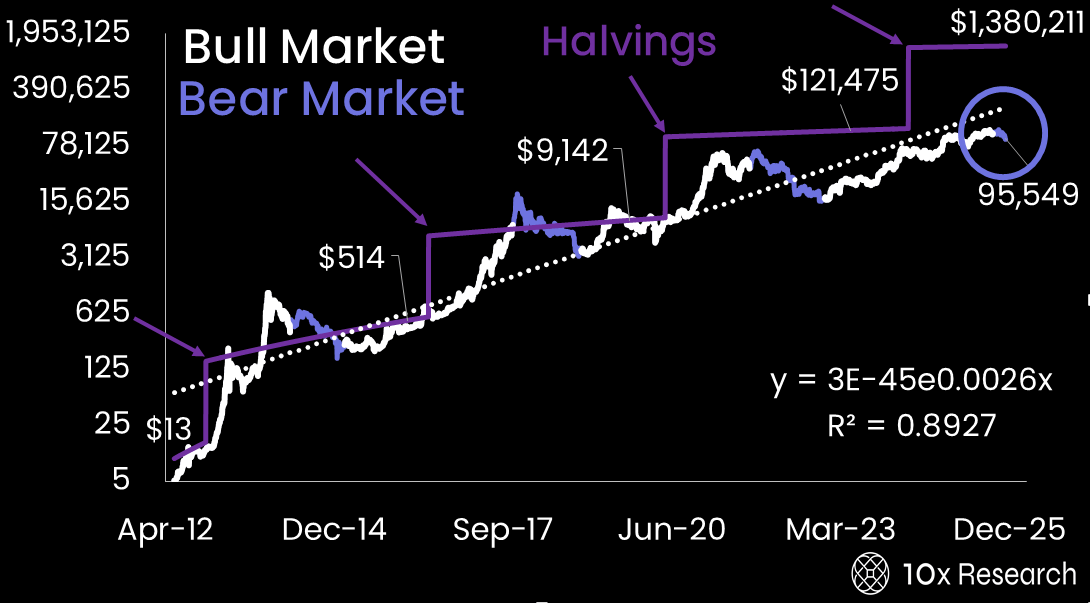

Bitcoin (log) stock to flow model and 4-year cycle (white bull market)

And while we place greater weight on on-chain signals and market-structure indicators, both of which can help identify when a bull market is ending, the cycle framework remains a distinct analytical lens. Our cycle-based work has been remarkably accurate. With that in mind, let’s take a closer look.

Standing on stage in May 2022, with Bitcoin still hovering near $40,000 (down from $67,000), I pointed out that if the four-year cycle continued to hold, a typical 70–75% drawdown implied a move toward $20,000 over the next five months. That is precisely what happened (1). At the time, even I struggled to believe the cycle could predict the decline so precisely, but the market once again followed the script.

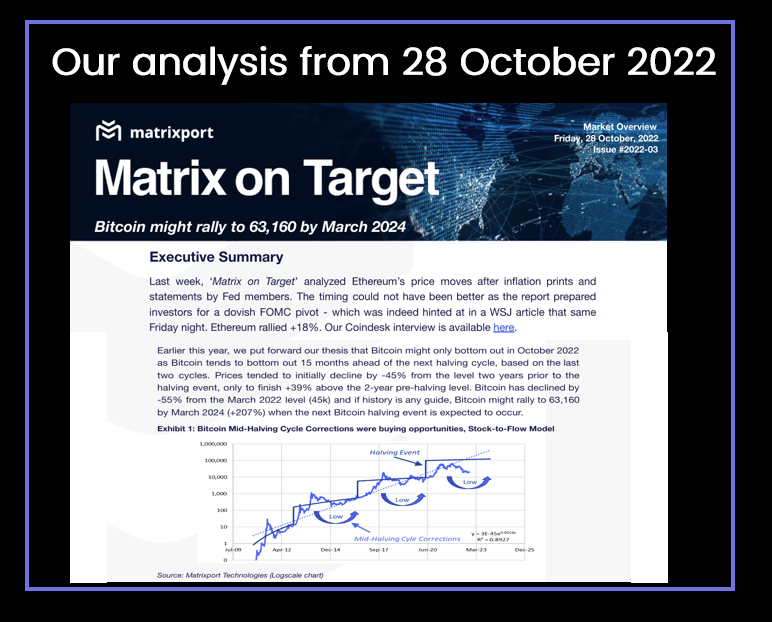

And indeed, on October 28, 2022, I published a report calling for the bottom of the bear market (2) and setting an intermediate target of $63,160 for the 2024 halving. Remarkably, that target materialized almost perfectly; Bitcoin traded within 1% of the level we projected 15–16 months earlier. While many still cling to the idea that the halving cycle is predictable through the stock-to-flow model, we have repeatedly shown that this framework has already failed: it projected $100,000 in the last cycle and an absurd $1.3 million in this one. Supporters continue to “refine” and “adjust” the model, but the reality is unchanged; it simply does not work.

And interestingly, on July 6, 2023, when Bitcoin was trading at just $30,830, we projected a cycle high (3) of $125,731 to be reached by the end of 2024. While the market did not deliver a classic parabolic blow-off top, but rather a drawn-out topping pattern, the timing remained broadly consistent with the cycle projection framework. Bitcoin’s actual all-time “cycle” high (4) of $126,270, reached on 6 October 2025, came astonishingly close to that forecast. It may be coincidence, but it is remarkable how the cycle theory once again captured both the cycle low, delayed slightly by the FTX collapse, and, at least so far, the high of this cycle with near-perfect accuracy.

Even after extensively backtesting the data, we still find it difficult to accept the cycle theory without reservation. Yet one rule of thumb remains: when Bitcoin’s upside momentum fades, a deeper correction often follows. This is why we have pointed out levels where investors should lock in profits for this cycle (see October 30 report).

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.