- 10x Market Update

- Posts

- Is Thanksgiving Bullish for Bitcoin?

Is Thanksgiving Bullish for Bitcoin?

Actionable Market Insights

Q4 is often called Bitcoin’s strongest quarter, but history shows those gains rarely come without a catalyst. While US equities usually enjoy a seasonal boost between Thanksgiving and Christmas, the same window has produced far more uneven outcomes for Bitcoin, despite its eye-catching average returns. Our latest analysis goes beyond simple seasonality and introduces a new “Combined Confidence” framework to separate statistical luck from genuine market edge.

Q4 has historically been Bitcoin’s strongest quarter, but those gains have never been random. In each year of outsized Q4 performance, they were driven by clear catalysts. While seasonality alone would have justified a bullish default stance, we flagged in September that we could not identify any catalyst strong enough to support such a view in 2025. This stood in contrast to October 2022, when we held a bullish non-consensus position, and late September 2023, when many still believed Bitcoin was merely consolidating. In mid-October 2024, sentiment only turned broadly bullish again.

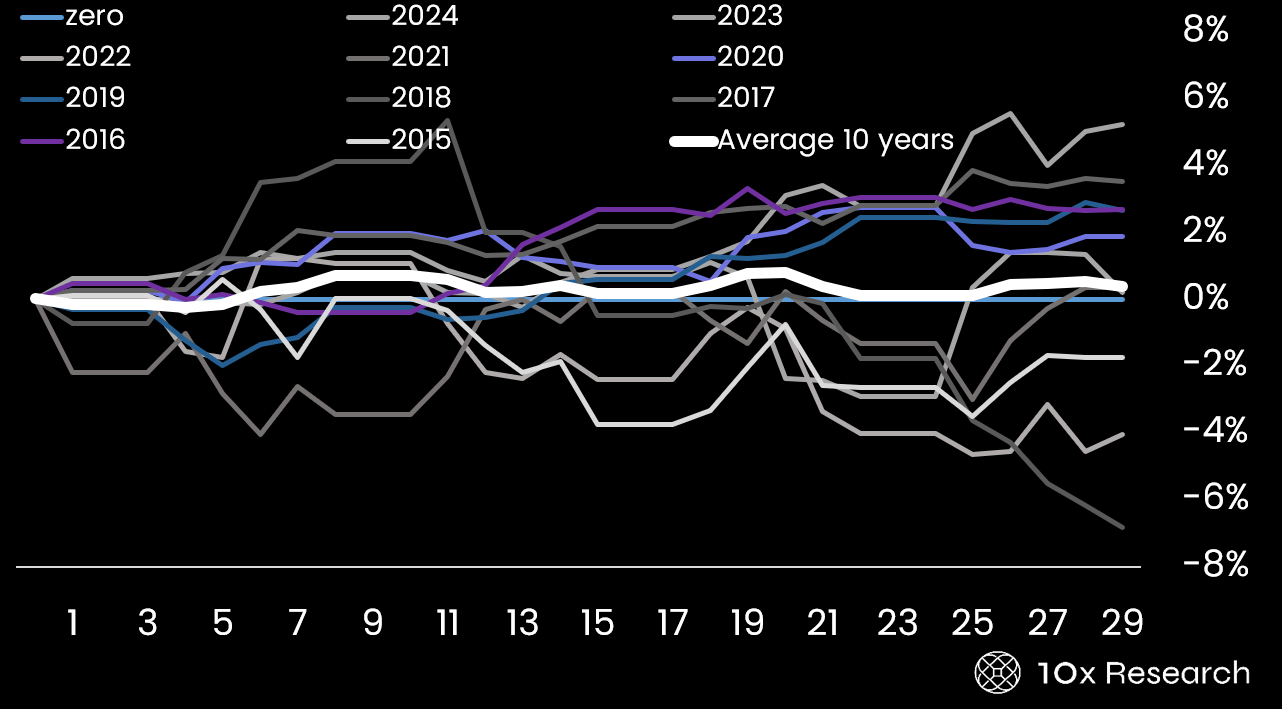

SP500 performance from Thanksgiving onwards (29 days towards Xmas)

US equities, and the S&P 500 in particular, have tended to deliver modest but consistently positive returns in the period from Thanksgiving to Christmas.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.