- 10x Market Update

- Posts

- FOMO? The One Bitcoin Signal OGs Are Watching Right Now

FOMO? The One Bitcoin Signal OGs Are Watching Right Now

Actionable Market Insights

Why This Report Matters

Bitcoin is hovering near all-time highs, and on-chain signals will flash subtle warnings. While price action remains strong, early holders are beginning to distribute their holdings to newer wallets. Retail participation is notably absent, replaced by steady demand from corporations and institutions. We've seen this pattern before—just before momentum reverses. Understanding who's buying and selling has helped us call past tops, and will again. This report reveals why the next move might be the most important one yet.

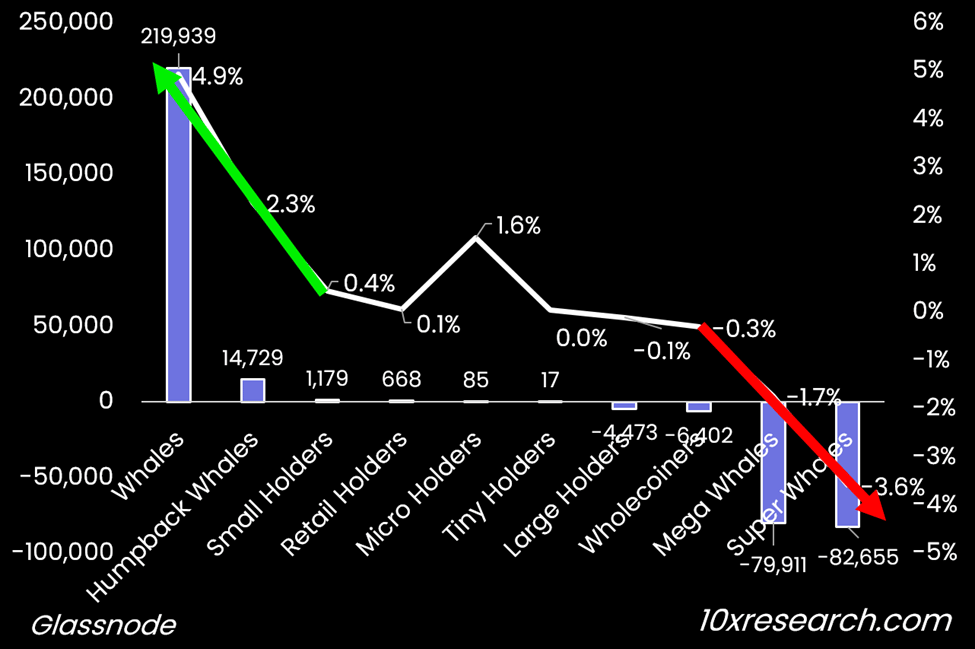

Bitcoin Whales are buying from the Mega & Super Whales (change in 2025)

Overview

On-chain data offers powerful insights into who is selling and who is buying, and tracking these flows has been instrumental in helping us identify key market tops, including in March 2024 and February 2025, when selling pressure from early Bitcoin holders began to overwhelm demand. We expect this data to once again signal when the current rally is nearing exhaustion and a deeper correction is likely to occur.

Just as importantly, our analysis of which investor segments were accumulating gave us confidence that the February–April pullback would be short-lived. Based on our cycle framework, we projected back in July 2023 that Bitcoin could peak at $125,000—a level now converging with our next price target of $122,000. This rally has unfolded in line with our forecasts, following our call for a breakout above $84,500 with an initial target of $95,000.

With the $106,000 level now reached, the path is open toward our next projected target. In anticipation of this move, we recommended rolling up Bitcoin call spreads from the $ 100,000 to $110,000 range to $ 110,000 to $120,000 last week, reflecting our expectation that Bitcoin would reach new all-time highs this week. However, we must remain vigilant—OG investors are likely to seek liquidity on the next price spike, and our on-chain data will be critical in assessing whether the market can absorb this anticipated supply.

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Receive 2-4 concise, informative Market Updates reports per week.

- • We cover everything that impacts the price of Bitcoin and other major cryptos, from on-chain data to macro and market structure (funding rates, money flows, etc.). Our insights are trusted by some of the largest hedge funds and traders in the industry.

- • You'll gain full access to our in-depth 'Market Update' analysis, informed by our experience at leading investment banks like Goldman Sachs, Morgan Stanley, and JP Morgan, as well as managing hedge fund capital at Millennium.

- • We rigorously backtest our insights and are unafraid to call bullish or bearish market conditions. Our research is unique and grounded in solid financial analysis, offering perspectives you won't find anywhere else.

- • --------------

- • Our clients include hedge funds, traders, liquidity providers, exchanges, family offices, proprietary traders, institutions, high-net-worth individuals (HNWIs), CEOs of major listed Bitcoin mining companies, executives from crypto service providers, TradeFi portfolio managers, etc.