- 10x Market Update

- Posts

- Ethereum: The $1.6 Billion Bitmine Compensation Plan That Assumes a $20,000 ETH Price

Ethereum: The $1.6 Billion Bitmine Compensation Plan That Assumes a $20,000 ETH Price

Actionable Market Insights

Why this report matters

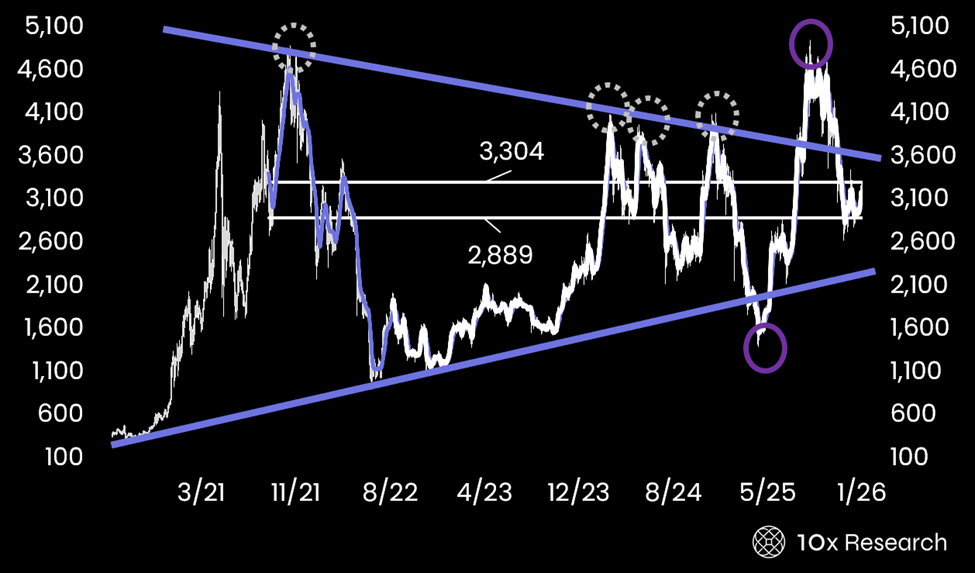

Ethereum has spent years consolidating within a broad range, and that kind of tension never resolves quietly. While ETF flows, derivatives positioning, and volumes suggest downside may be limited, something else is happening beneath the surface: incentives are becoming increasingly asymmetric, especially in Ethereum-linked treasury vehicles.

One company now sits at the intersection of ETH price action, Wall Street demand, and one of the most aggressive compensation structures ever proposed in crypto markets.

The question isn’t whether Ethereum can move. It’s who gets paid even if it doesn’t.

Our latest report breaks down the numbers, probabilities, and assumptions embedded in current valuations before they become consensus.

Ethereum - multi-year narrowing triangle - a break is coming either way

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.