- 10x Market Update

- Posts

- Bitcoin’s $30+ Billion Overhang: Where the Cycle Low Likely Forms

Bitcoin’s $30+ Billion Overhang: Where the Cycle Low Likely Forms

Actionable Market Insights

Why this report matters

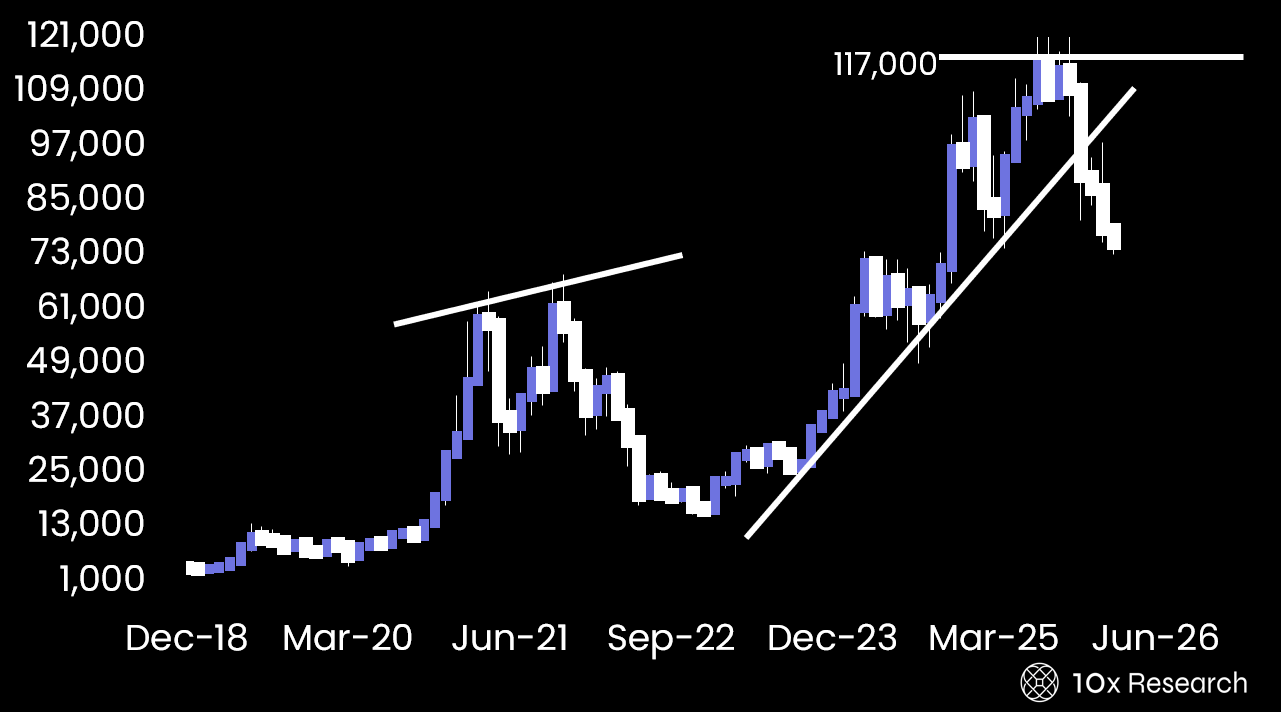

Shortly after the Bahamas FTX conference in early 2022, I presented a scenario arguing that, if Bitcoin followed prior cycle dynamics, prices could decline from around $40,000 to below $20,000, with a potential bottom forming by October 2022. I was mentally prepared for the correction despite prevailing optimism at the time, particularly as key industry players such as FTX and Binance appeared to have virtually unlimited capital to acquire distressed competitors and to backstop the market.

While extrapolating from only a handful of historical cycles is not statistically robust, Bitcoin has repeatedly shown that cycle analysis, despite its simplicity, can be an effective way to step back and understand how market psychology evolves through distinct phases.

Each cycle introduces new narratives and promoters, often successfully attracting billions and, in this cycle, tens of billions of dollars in capital for single investments. Ironically, it is the subsequent reassessment of these allocations by investors, and the unwinding of the capital raised, that is now exerting downward pressure on Bitcoin. This dynamic closely resembles the forced liquidations of the summer of 2022.

At current levels, the $3.5 billion in paper losses facing MicroStrategy mirrors the scale of the collapse of Three Arrows Capital. Meanwhile, Bitmine’s staggering $8 billion paper loss draws a sobering (financial) parallel to the losses sustained by FTX users. While the magnitude of these drawdowns echoes that of the 2022 bear market, history suggests that this cycle will eventually find its floor. Below, we outline the expected timing of Bitcoin's next cycle low and the price levels likely to accompany it.

Bitcoin

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.