- 10x Market Update

- Posts

- Are Bitcoin Option Traders Misreading BTC’s Next Move?

Are Bitcoin Option Traders Misreading BTC’s Next Move?

Actionable Market Insights

Why this report matters

Most traders appear either complacent or overly focused on downside risk in Bitcoin this month, as reflected in positioning across derivatives markets. After three months of range-bound trading and a lack of clear catalysts, it’s natural that activity has slowed and sentiment has turned quiet. We anticipated a subdued summer, and that expectation has played out. But this is not the moment to fall asleep at the wheel—beneath the surface, important shifts are emerging. If these early trends persist, the implications for Bitcoin could be significant, making the direction of the next major move increasingly obvious.

Main argument

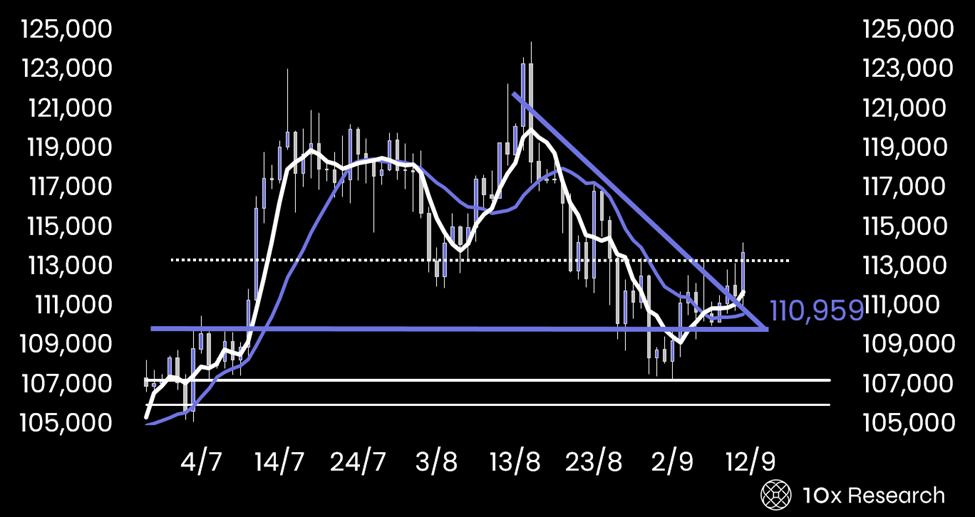

The tariff-inflation camp found fresh momentum after last month’s unexpectedly strong PPI print, driving a surge in hedging demand to guard against Bitcoin downside. And while the latest Bitcoin triangle breakout is not the cleanest technical formation, it does mark a decisive shift from the mid-August correction triggered by that hotter-than-expected PPI print.

Bitcoin - potential triangle breakout?

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Important Trading alerts and risk factor analysis.:

- • Actionable market analysis that saves you hours.

- • Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- • Focused on Bitcoin and top crypto assets.

- • Get 2–5 Reports per Week. Know More. Doubt Less.

- • Turning market insights into confident action.