Why this report matters

Markets are flashing signals that the next move could be decisive. Options traders are paying up for downside protection, but technicals suggest the picture may not be so one-sided. Treasury yields are breaking lower, rate cuts are now priced in, and the Fed faces its most pivotal test of the year. Bitcoin is hanging onto the $106,000–108,000 support zone—will it hold or finally crack? Two highly asymmetric trades could define the next big move. With catalysts stacking up fast, timing isn’t just important—it’s everything.

Bitcoin Options Traders Turn Bearish—But Are They Wrong?

Main argument

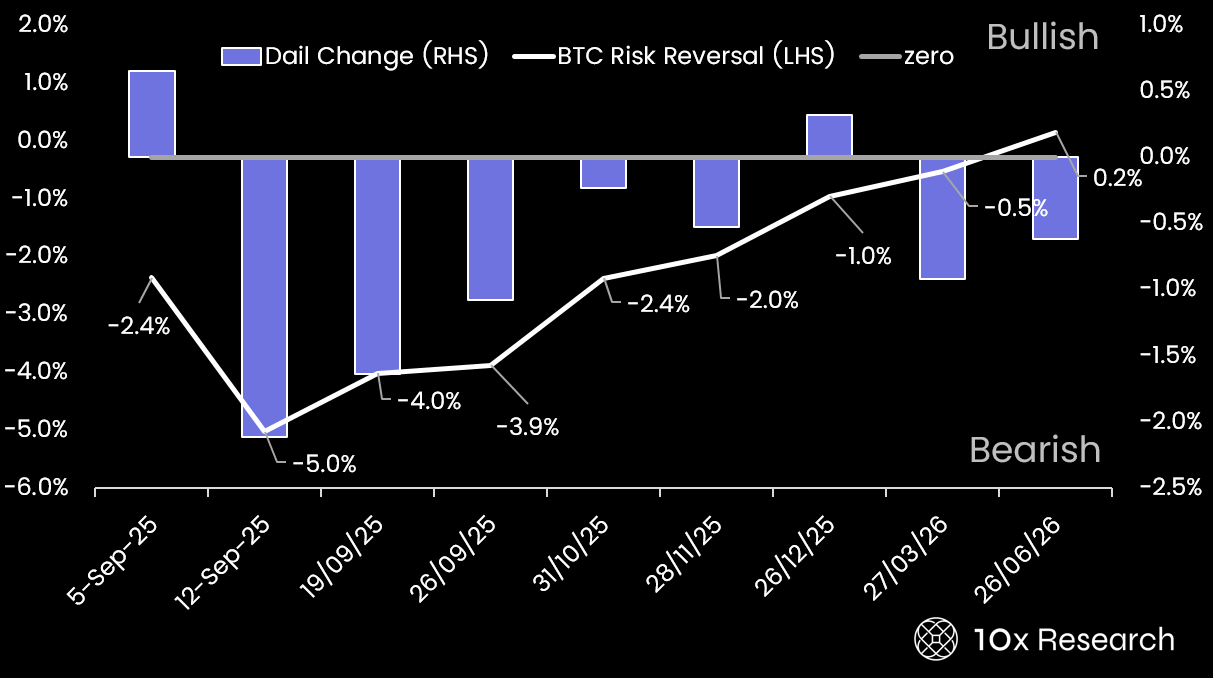

The Bitcoin options market (sign up or see pricing here) is flashing clear warning signs: traders are pricing in event-driven downside risk, likely tied to the upcoming U.S. jobs data, BLS revisions, CPI, and the September 17 FOMC. Skew is deeply negative, with near-term expiries (Sep 6 and Sep 12) sitting at –4.3%, reflecting heavy demand for puts over calls. This tilt means traders are paying up for downside protection, fearing a sharp drop. But what does this mean historically? And what are trades?

Market Updates

Become a paying subscriber of Market Updates to get access to this post and other subscriber-only content.

UpgradeImportant Trading alerts and risk factor analysis.:

- Actionable market analysis that saves you hours.

- Covers on-chain data, macro trends, market structure, flows, catalysts, and more.

- Focused on Bitcoin and top crypto assets.

- Get 2–5 Reports per Week. Know More. Doubt Less.

- Turning market insights into confident action.