- 10x Market Update

- Posts

- 10x Weekly Crypto Kickoff – When Liquidity Vanishes, Positioning Decides the Next Move

10x Weekly Crypto Kickoff – When Liquidity Vanishes, Positioning Decides the Next Move

The Week Ahead in Crypto Markets

The report covers derivatives positioning, volatility trends, and funding dynamics across Bitcoin and Ethereum, along with sentiment, technical signals, ETF and stablecoin flows, option activity, expected trading ranges for the next 1–2 weeks, and key upcoming market catalysts.

Why this report matters

Crypto markets are entering the new year with activity at cycle lows, yet derivatives positioning is quietly sending a very different signal. Volatility is compressing, funding is drifting higher, and leverage remains somewhat elevated, even as volumes and participation continue to fade. ETF flows, stablecoin activity, and futures positioning are no longer aligned, creating a market that looks calm on the surface but increasingly fragile underneath.

Options markets are adjusting in ways that typically precede regime shifts rather than trend continuation. At the same time, technical indicators are approaching levels where small moves can trigger larger reallocations.

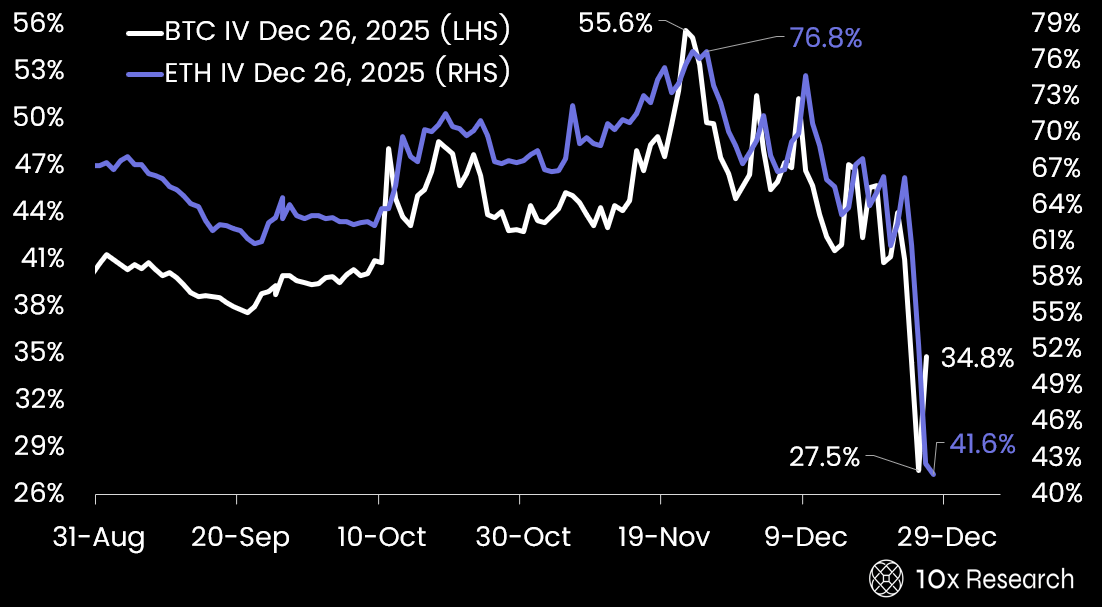

Bitcoin and Ethereum Implied Volatility collapsed into year end.

Main data points

Crypto trading volumes are 30% lower than usual. The Crypto market cap stands at $2.96 trillion, down 0.7% from the week before, with an average weekly volume of $79 billion, down 26% from the average. Weekly Bitcoin volume was $28.9 billion, 36% below average, while Ethereum volume was $14.8 billion, 32% below average. Ethereum network fees (0.04 Gwei) are in the 4th percentile, indicating low network usage.

Funding rates are moderately higher, as the orderly unwinding of futures exposure continues. The Bitcoin funding rate rose 3.7% this week to 8.9%, placing it in the 57th percentile over the past 12 months. Futures open interest decreased by $-500 million to $27.3 billion. The Ethereum funding rate rose 3.4% this week to 6.9%, placing it in the 34th percentile over the last 12 months. Futures open interest decreased by $-300 million to $17.7 billion. Bitcoin's open interest is at the 46th percentile, whereas Ethereum's is at the 77th percentile.

No clear trend in Bitcoin’s dominance. Bitcoin's dominance is 58.9%, down 0.1%, and Ethereum's is 11.9%, down 0.1%. Our model favors Bitcoin over altcoins, with Bitcoin expected to outperform. The model is 0.1% away from flipping Bitcoin dominance.

Stablecoin off-ramp continues, a moderately bearish sign. The Tether USDT market cap is $186.8 billion, 0% lower than a week ago, while volume was $65.3 billion, -21% lower than average. Circle's USDC market cap is $76.3 billion, down 0.9% from a week ago, while volume was $8.9 billion, down 11% from average. The stablecoin minting indicator is in the 5th percentile, which is very negative. Last week, Stablecoins experienced a $-0.7 billion decrease (offramp), a negative signal relative to previous mints, which is in the 2nd percentile. Over the past 30 days, only $2 billion was minted.

BTC and ETH ETFs continue to experience outflows, pressuring crypto assets. Bitcoin outflows were $-940 million over the last 7 days, which is in the 7th percentile, vs. $-857 million over the previous 30 days, which is in the 11th percentile. Bitcoin ETFs are experiencing $5.7 billion in outflows since the October FOMC meeting and $1.3 billion since the December FOMC meeting. After $3.5 billion in outflows in November, Bitcoin ETFs saw another $1.1 billion in outflows in December. Ethereum outflows were $-179 million over the last 7 days, which is in the 23rd percentile, compared with $-385 million over the previous 30 days, which is in the 26th percentile. The ETH ETFs have seen $2.6 billion in outflows since the October FOMC meeting and $800 million since the December FOMC meeting. Without the $9.5 billion in inflows during the July-August Bitmain hype, ETH ETF inflows in 2025 have been negative for the year.

Crypto inflows have significantly slowed since September; without inflows, there is no upside risk. Year-to-date, crypto markets have seen $136.7 billion inflows, notably $80.4 billion from Stablecoins, $45.2 billion into Bitcoin (ETFs, Futures, MSTR), and $11.1 billion through Ethereum.

BTC downtrend remains in place but likely flipping to bullish in January. Bitcoin's RSI stood at 43% with a Bullish indication, while the Stochastics indicator stood at 30% with a Bearish indication. An RSI above 70% combined with Stochastics above 90% may signal bearish conditions, while an RSI below 30% and Stochastics below 10% could indicate a bullish reversal. Bitcoin is 4.5% away from triggering a trend change, with the current trend being Bearish. A critical level is the 88,421 level for short-term bullish/bearish views. Major Bull/Bear Level is 98,759.

ETH could also experience a bullish trend change in January. Ethereum's RSI stood at 44% with a Bullish indication, while the Stochastics indicator stood at 23% with a Bearish indication. An RSI above 70% combined with Stochastics above 90% may signal bearish conditions, while an RSI below 30% and Stochastics below 10% could indicate a bullish reversal. Ethereum is 5% away from triggering a trend change, with the current trend being Bearish. A critical level is the 2,991 level for short-term bullish/bearish views. Major Bull/Bear Level is 3,363.

Sentiment remains lackluster: Our Bitcoin Greed & Fear Index is 24% (range 0-100%) versus 32% a week ago, indicating negative short-term sentiment. Our Ethereum Greed & Fear Index is 36% (range 0-100%), down from 47% a week ago, indicating negative short-term sentiment. Sentiment readings above 90% typically indicate market exuberance and heightened risk of correction. In contrast, levels below 10% often suggest conditions for a bullish reversal.

BTC and ETH realized volatility have begun to decline meaningfully: Bitcoin's 30-day realized volatility stands at 38.2%, compared with its 30-day average of 45%, or 7% lower. Ethereum's 30-day realized volatility is 61.2%, five percentage points lower than its 30-day average of 66.6%. The realized volatility spread between ETH and BTC is in the 72nd percentile, at 1.6, compared with a cycle average of 1.43. Bitcoin's volatility is at the 34th percentile, whereas Ethereum's is at the 50th percentile.

Potential range over the next week (based on realized volatility): BTC:

With a last price of 87,461 and a 30-day realized volatility of 38.2%, the 1-week volatility is approximately 5.3%. This implies a 68% confidence interval of roughly 82,800 to 92,100, suggesting Bitcoin is likely to trade within this range over the next week, barring a volatility shock. ETH: With a last price of 2,935 and a 30-day realized volatility of 61.2%, the 1-week volatility is approximately 8.5%. This yields a 68% confidence interval of approximately 2,685-3,185, indicating a substantially wider near-term trading range relative to Bitcoin.

What traders are pricing in: Derivatives markets are pricing a 3.1% move in BTC over the coming week, with the move expanding to around 5.2% the following week. This implies a trading range of approximately $84,953 to $90,383 this week and of roughly $83,252 to $92,362 by next week. For ETH, traders anticipate a sharper swing of 4.7% this week, widening further to nearly 7.9% by next week’s close. This implies a trading range of about $2,801 to $3,081 for this week and to roughly $2,712 to $3,176 by next week.

49% of BTC option notional and 43% of ETH option notional rolled off with last week’s expiry: BTC option flows were predominantly Calls Bought (likely closing out the calls they previously sold), which accounted for 27% of the (notional) volume during the last week, followed by BTC Puts Bought, which accounted for 25.3% of the volume. Traders are predominantly buying BTC volatility. ETH option flows were predominantly Calls Sold, accounting for 36.6% of volume over the last week, followed by ETH Calls Bought, accounting for 29.2%. BTC option notional is $21.5 billion, an increase of 7% from a year ago and a decrease of -49% from a week ago. The ETH option notional is $4.1 billion, a 13% decrease from a year ago and a 43.4% decrease from a week ago.

BTC traders favor volatility-selling strategies as near-term consolidation is expected: Bitcoin’s implied volatility curve has shifted lower across all maturities relative to a week ago, with the largest declines at the front end, thereby flattening the curve. This reflects reduced demand for near-term protection and lower expectations of immediate volatility, consistent with a fading spot market. BTC skew has moved less negative across the curve, indicating that downside put demand has eased while call demand has improved relatively. This shift signals reduced tail-risk hedging and a mild improvement in risk sentiment. Traders appear to be positioning for near-term consolidation rather than a sharp sell-off, likely favoring volatility-selling strategies and modest upside exposure, while deferring protection against larger moves to later maturities.

ETH option traders are also selling volatility, notably through heavy call selling: Ethereum’s implied volatility curve has shifted meaningfully lower across all maturities relative to a week ago, with the largest compression at the front end, flattening the curve. This signals reduced expectations for near-term realized volatility despite ETH’s recent price weakness. ETH skew has moved sharply higher (less negative to near-flat/positive), particularly in the mid-to-back end, indicating a reduction in downside put demand and growing interest in calls. Traders appear to be unwinding downside hedges and selectively positioning for upside or range-bound outcomes, favoring volatility-selling structures and call overwrites/diagonals rather than outright bearish protection.

BTC futures volume collapsed. Bitcoin fell 1% over the past week, with funding rates rising 3.7% despite a 47% collapse in trading volumes and a modest 1.8% decline in open interest. This indicates that while some participation has faded, the remaining traders have shifted toward more leveraged long positions, pushing funding into the 68th percentile even as overall activity remains at extreme lows. Compared with last week, the market is thinner but more crowded, making it more sensitive to small price moves. In the near term, this imbalance skews risk toward sharp downside air pockets on negative catalysts, while upside appears constrained unless participation and spot demand recover.

Leveraged ETH futures positioning remains high compared to ETH performance: Ethereum fell 1.9% over the past week, yet positioning remains relatively crowded, with open interest still elevated in the 77th percentile despite a sharp 60% collapse in trading volumes and a modest 1.7% decline in open interest. Funding rates rose 3.4% but remain only in the 38th percentile, suggesting leverage has increased at the margin without reaching extreme levels. Compared with last week, participation has declined meaningfully, while aggregate positioning remains sticky, implying that traders have reduced activity more than exposure. In the near term, this combination increases downside risk from liquidity-driven moves, while upside appears limited unless volumes and spot demand recover.

Calendar/Earnings: December 29: OP $10m unlock; subsequent FOMC meetings on January 28, March 18, and April 29, 2026. Holidays: Jan 1 & Jan 19 (Markets Closed). Data: Jobs (Jan 9), CPI (Jan 13). Fiscal/Policy: Tax payments due (Jan 15), FOMC Meeting (Jan 27–28), Gov. Shutdown Risk (Jan 30). Options: SPX (Jan 16), BTC (Jan 30). Crypto: EU tax transparency, DAC8, Jan 1

Market View: Over the past six weeks, we have recommended selling BTC upside calls at $100,000 and downside puts at $70,000 as an attractive range-trading strategy, based on our view that Bitcoin would remain range-bound while implied volatility was elevated (see the November 24 kickoff report on the short strangle). This positioning has played out well: Bitcoin has held within the $85,000–$90,000 range, while implied volatility has compressed sharply from roughly 55% to 35%. This short strangle trade has generated 2.6% (approximately 26% annualized).

In the absence of a strong macro or crypto-specific catalyst, flows, not narratives, have dominated price action. As we highlighted following the October FOMC meeting, the risk of sustained ETF net selling was elevated, and this has indeed materialized, capping upside and shifting the balance of flows. With year-end now behind us, however, these sell pressures are likely to moderate.

From a technical perspective, Bitcoin is currently trading near the middle of its indicator ranges, suggesting limited directional conviction. As outlined in our prior report (here), traders should be prepared to position themselves in the direction of the next decisive break, with our analysis now assigning slightly higher odds to a bullish breakout from the January downtrend. This bullish shift is a shift from the bearish view we had since late October (here).

Disclaimer: This email and any attached research are for informational purposes only and do not constitute investment advice, financial advice, or a recommendation to buy or sell any assets. 10x Research does not provide personalized investment advice and is not registered as a broker-dealer or investment adviser. Views are the authors’ own and subject to change. Please consult a qualified professional before making financial decisions. ©10x Research.